annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Work began on the construction contracts in the <strong>2009</strong> financial year. The respective contractual agreements foresee<br />

completion in 2010. The construction contracts recognized at the balance sheet date on December 31, 2008 were<br />

completed in <strong>2009</strong>.<br />

Sales totaling u 51,954 thousand have been recognized for construction contracts in the statement of comprehensive<br />

income for the <strong>2009</strong> financial year (previous year: u 39,341 thousand).<br />

The future receivables from construction contracts recognized as of December 31, <strong>2009</strong> and as of the previous year’s<br />

balance sheet date were neither impaired nor overdue.<br />

(8) Receivables from associates<br />

The figure of u 165 thousand stated (previous year: u 167 thousand) relates to trade receivables of u 67 thousand (previous<br />

year: u 56 thousand) due at Sanguin International Ltd. (UK) from Sanguin International Inc. (USA), and to a loan receivable<br />

of u 98 thousand (previous year: u 98 thousand) due at <strong>STRATEC</strong> <strong>AG</strong> from its US subsidiary <strong>STRATEC</strong> <strong>Biomedical</strong><br />

Inc. The remaining term of the loan, which bears interest at 6 % per annum, amounts to three months.<br />

These receivables have been assigned to the “Loans and receivables” category pursuant to IAS 39 and measured at<br />

amortized cost at the balance sheet date. They were neither impaired nor overdue as of December 31, <strong>2009</strong>, or at the<br />

previous year’s balance sheet date.<br />

The receivables due from associates are subject to foreign currency risks, but these do not have any material impact on<br />

consolidated earnings.<br />

(9) Income tax receivables<br />

The amount of u 140 thousand stated for the previous year relates to the refund claim at Robion <strong>AG</strong> due to prepayments<br />

of current income taxes, as well as to refund claims for withholding taxes withheld for the 2008 financial year.<br />

(10) Other receivables and other assets<br />

Other receivables and other assets have largely been allocated to the “Loans and receivables” category and have mainly<br />

been measured at amortized cost.<br />

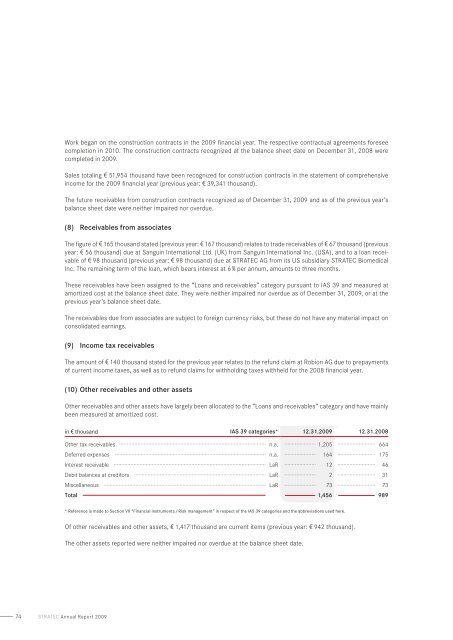

in v thousand IAS 39 categories* 12.31.<strong>2009</strong> 12.31.2008<br />

Other tax receivables n.a. 1,205 664<br />

Deferred expenses n.a. 164 175<br />

Interest receivable LaR 12 46<br />

Debit balances at creditors LaR 2 31<br />

Miscellaneous LaR 73 73<br />

Total 1,456 989<br />

* Reference is made to Section VII “Financial instruments / Risk management” in respect of the IAS 39 categories and the abbreviations used here.<br />

Of other receivables and other assets, u 1,417 thousand are current items (previous year: u 942 thousand).<br />

The other assets reported were neither impaired nor overdue at the balance sheet date.<br />

74 stratec Annual <strong>Report</strong> <strong>2009</strong>