annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong> of the board of Management<br />

<strong>Report</strong> of the supervisory board<br />

THE share<br />

Corporate Governance<br />

Group Management report<br />

Consolidated financial statements<br />

Service<br />

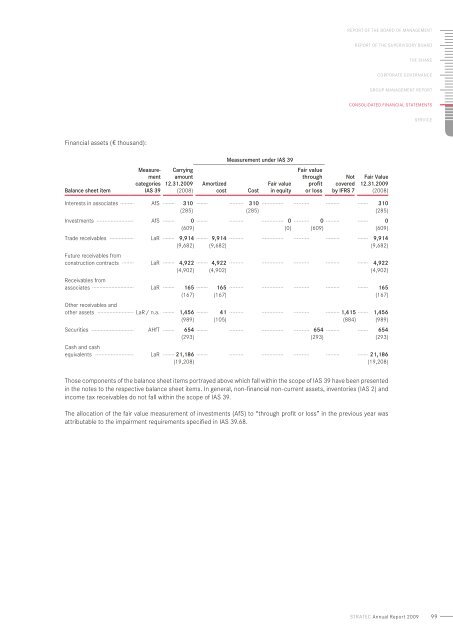

Financial assets (u thousand):<br />

Measurement under IAS 39<br />

Balance sheet item<br />

Measurement<br />

categories<br />

IAS 39<br />

Carrying<br />

amount<br />

12.31.<strong>2009</strong><br />

(2008)<br />

Amortized<br />

cost<br />

Cost<br />

Fair value<br />

in equity<br />

Fair value<br />

through<br />

profit<br />

or loss<br />

Not<br />

covered<br />

by IFRS 7<br />

Fair Value<br />

12.31.<strong>2009</strong><br />

(2008)<br />

Interests in associates AfS 310<br />

(285)<br />

310<br />

(285)<br />

310<br />

(285)<br />

Investments AfS 0<br />

(609)<br />

0<br />

(0)<br />

0<br />

(609)<br />

0<br />

(609)<br />

Trade receivables LaR 9,914<br />

(9,682)<br />

9,914<br />

(9,682)<br />

9,914<br />

(9,682)<br />

Future receivables from<br />

construction contracts LaR 4,922<br />

(4,902)<br />

4,922<br />

(4,902)<br />

4,922<br />

(4,902)<br />

Receivables from<br />

associates LaR 165<br />

(167)<br />

165<br />

(167)<br />

165<br />

(167)<br />

Other receivables and<br />

other assets LaR / n.a. 1,456<br />

(989)<br />

41<br />

(105)<br />

1,415<br />

(884)<br />

1,456<br />

(989)<br />

Securities AHfT 654<br />

(293)<br />

654<br />

(293)<br />

654<br />

(293)<br />

Cash and cash<br />

equivalents LaR 21,186<br />

(19,208)<br />

21,186<br />

(19,208)<br />

Those components of the balance sheet items portrayed above which fall within the scope of IAS 39 have been presented<br />

in the notes to the respective balance sheet items. In general, non-financial non-current assets, inventories (IAS 2) and<br />

income tax receivables do not fall within the scope of IAS 39.<br />

The allocation of the fair value measurement of investments (AfS) to “through profit or loss” in the previous year was<br />

attributable to the impairment requirements specified in IAS 39.68.<br />

stratec Annual <strong>Report</strong> <strong>2009</strong><br />

99