annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

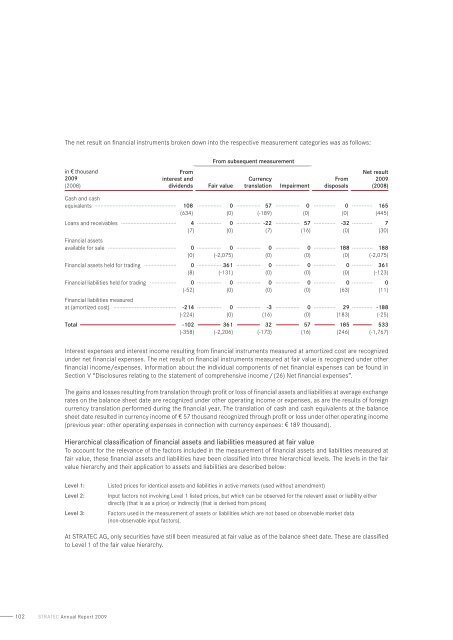

The net result on financial instruments broken down into the respective measurement categories was as follows:<br />

From subsequent measurement<br />

in v thousand<br />

<strong>2009</strong><br />

(2008)<br />

From<br />

interest and<br />

dividends<br />

Fair value<br />

Currency<br />

translation<br />

Impairment<br />

From<br />

disposals<br />

Net result<br />

<strong>2009</strong><br />

(2008)<br />

Cash and cash<br />

equivalents 108<br />

(634)<br />

0<br />

(0)<br />

57<br />

(-189)<br />

0<br />

(0)<br />

0<br />

(0)<br />

165<br />

(445)<br />

Loans and receivables 4<br />

(7)<br />

0<br />

(0)<br />

-22<br />

(7)<br />

57<br />

(16)<br />

-32<br />

(0)<br />

7<br />

(30)<br />

Financial assets<br />

available for sale 0<br />

(0)<br />

0<br />

(-2,075)<br />

0<br />

(0)<br />

0<br />

(0)<br />

188<br />

(0)<br />

188<br />

(-2,075)<br />

Financial assets held for trading 0<br />

(8)<br />

361<br />

(-131)<br />

0<br />

(0)<br />

0<br />

(0)<br />

0<br />

(0)<br />

361<br />

(-123)<br />

Financial liabilities held for trading 0<br />

(-52)<br />

0<br />

(0)<br />

0<br />

(0)<br />

0<br />

(0)<br />

0<br />

(63)<br />

0<br />

(11)<br />

Financial liabilities measured<br />

at (amortized cost) -214<br />

(-224)<br />

0<br />

(0)<br />

-3<br />

(16)<br />

0<br />

(0)<br />

29<br />

(183)<br />

-188<br />

(-25)<br />

Total -102<br />

(-358)<br />

361<br />

(-2,206)<br />

32<br />

(-173)<br />

57<br />

(16)<br />

185<br />

(246)<br />

533<br />

(-1,767)<br />

Interest expenses and interest income resulting from financial instruments measured at amortized cost are recognized<br />

under net financial expenses. The net result on financial instruments measured at fair value is recognized under other<br />

financial income/expenses. Information about the individual components of net financial expenses can be found in<br />

Section V “Disclosures relating to the statement of comprehensive income / (26) Net financial expenses”.<br />

The gains and losses resulting from translation through profit or loss of financial assets and liabilities at average exchange<br />

rates on the balance sheet date are recognized under other operating income or expenses, as are the results of foreign<br />

currency translation performed during the financial year. The translation of cash and cash equivalents at the balance<br />

sheet date resulted in currency income of u 57 thousand recognized through profit or loss under other operating income<br />

(previous year: other operating expenses in connection with currency expenses: u 189 thousand).<br />

Hierarchical classification of financial assets and liabilities measured at fair value<br />

To account for the relevance of the factors included in the measurement of financial assets and liabilities measured at<br />

fair value, these financial assets and liabilities have been classified into three hierarchical levels. The levels in the fair<br />

value hierarchy and their application to assets and liabilities are described below:<br />

Level 1:<br />

Level 2:<br />

Level 3:<br />

Listed prices for identical assets and liabilities in active markets (used without amendment)<br />

Input factors not involving Level 1 listed prices, but which can be observed for the relevant asset or liability either<br />

directly (that is as a price) or indirectly (that is derived from prices)<br />

Factors used in the measurement of assets or liabilities which are not based on observable market data<br />

(non-observable input factors).<br />

At <strong>STRATEC</strong> <strong>AG</strong>, only securities have still been measured at fair value as of the balance sheet date. These are classified<br />

to Level 1 of the fair value hierarchy.<br />

102 stratec Annual <strong>Report</strong> <strong>2009</strong>