annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Report</strong> of the board of Management<br />

<strong>Report</strong> of the supervisory board<br />

THE share<br />

Corporate Governance<br />

Group Management report<br />

Consolidated financial statements<br />

Service<br />

§ 4 (4.6) Paragraph 4 of the Articles of Association provides for Conditional Capital V. This conditional capital increase<br />

serves to grant subscription rights (stock options) up to May 19, 2014 on the basis of the resolution adopted by the<br />

Annual General Meeting on May 20, <strong>2009</strong>. The conditional capital increase is only exercised to the extent that bearers<br />

of stock options actually exercise their subscription rights. The new shares have profit entitlement from the beginning of<br />

the financial year in which they are issued. Conditional Capital V amounted to u 800,000.00 as of December 31, <strong>2009</strong>.<br />

Furthermore, § 4 (4.7) of the Articles of Association provides for Conditional Capital IV, which amounts to u 500,000.<br />

Conditional Capital IV serves exclusively to grant up to 500,000 new ordinary bearer shares to the bearers or creditors of<br />

warrant or convertible bonds issued pursuant to the resolution adopted by the Annual General Meeting on June 23, 2006<br />

by the company or by companies in which the company holds direct or indirect majority shareholdings.<br />

Total conditional capital (Conditional Capitals I–V) thus amounts to u 1,552 thousand as of December 31, <strong>2009</strong> (previous<br />

year: u 1,360 thousand).<br />

Treasury stock<br />

The authorization to acquire treasury stock granted by the Annual General Meeting on May 31, 2008 was rescinded<br />

by resolution of the Annual General Meeting held on May 20, <strong>2009</strong>. Furthermore, the Annual General Meeting held on<br />

May 20, <strong>2009</strong> authorized the company until November 19, 2010 to acquire further treasury stock up to a total of 10 %<br />

of the share capital. Alongside disposal via the stock exchange or by way of a public offer addressed to all shareholders,<br />

the treasury stock thereby newly acquired or already acquired on the basis of earlier authorizations may be used as<br />

follows:<br />

• Subject to approval by the Supervisory Board, the treasury stock may be retired without any further resolution being<br />

required.<br />

• The treasury stock may be used to the exclusion of shareholders’ subscription rights to service subscription rights<br />

granted to directors, officers and employees of the company and of other associated companies in which majority<br />

shareholdings are held within the framework of stock option programs based on resolutions adopted by the Annual<br />

General Meeting.<br />

• The treasury stock may be sold to third parties to the exclusion of shareholders’ subscription rights in return for noncash<br />

contributions within the framework of business combinations or to acquire companies, sections of companies or<br />

shareholdings in companies.<br />

• The treasury stock may be sold to third parties to the exclusion of shareholders’ subscription rights in ways other than<br />

via the stock exchange, but the selling price may not fall significantly short of the share’s average closing price in XETRA<br />

trading at the Frankfurt Stock Exchange on the five trading days preceding the substantiation of the disposal obligation<br />

and may not exceed the ten percent limit set out in § 186 (3) Sentence 4 of the German Stock Corporation Act (AktG)<br />

including any utilization of other authorizations to exclude subscription rights pursuant to § 186 (3) Sentence 4 of the<br />

German Stock Corporation Act (AktG) in the period since this authorization became effective.<br />

The company made no use of this authorization in <strong>2009</strong>.<br />

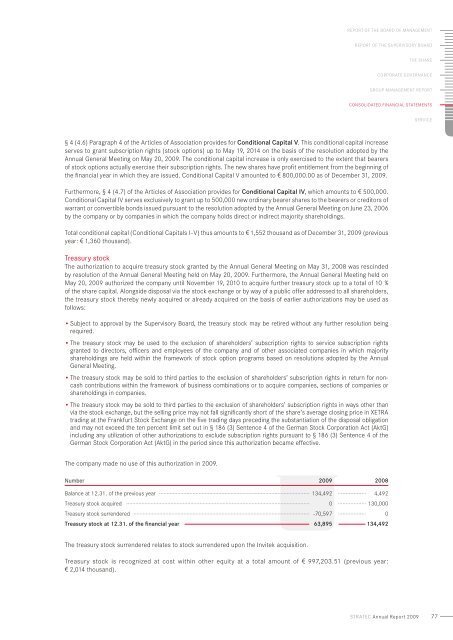

Number <strong>2009</strong> 2008<br />

Balance at 12.31. of the previous year 134,492 4,492<br />

Treasury stock acquired 0 130,000<br />

Treasury stock surrendered -70,597 0<br />

Treasury stock at 12.31. of the financial year 63,895 134,492<br />

The treasury stock surrendered relates to stock surrendered upon the Invitek acquisition.<br />

Treasury stock is recognized at cost within other equity at a total amount of u 997,203.51 (previous year:<br />

u 2,014 thousand).<br />

stratec Annual <strong>Report</strong> <strong>2009</strong><br />

77