annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong> of the board of Management<br />

<strong>Report</strong> of the supervisory board<br />

THE share<br />

Corporate Governance<br />

Group Management report<br />

Consolidated financial statements<br />

Service<br />

Risk management<br />

Principles of risk management<br />

The assets, liabilities and future activities of <strong>STRATEC</strong> <strong>AG</strong> are subject to risks resulting from changes in exchange rates,<br />

interest rates and stock market prices. The objectives and methods used by the <strong>STRATEC</strong> Group to deal with the financial<br />

risks listed below form the object of the Group’s risk management activities. The principles underlying the Group’s risk<br />

management policies are presented in the “Risk <strong>Report</strong>” section of the group management report.<br />

The objective of financial risk management is to limit these risks primarily by means of operating activities. These measures<br />

are supplemented by finance-based measures. The primary objective is to limit the risks of relevance to the cash flow.<br />

The basic principles of the company’s financial policy are reviewed by the Board of Management <strong>annual</strong>ly and revised<br />

to account for new developments. The Supervisory Board is informed at regular intervals of the financial position of the<br />

Group and the assessments made by the Board of Management.<br />

The financial instruments reported in the accounts could in principle give rise to the following risks for the company:<br />

Foreign currency risks<br />

<strong>STRATEC</strong> <strong>AG</strong> may be exposed to foreign currency risks as a result of its investments, financing measures and operating<br />

activities.<br />

These risks have not been secured to date, since they only affect the cash flow of the Group to an immaterial extent.<br />

These risks mainly relate to the translation of the financial statements of foreign group companies into the group reporting<br />

currency (u). Exchange rate volatility thus affects consolidated earnings, as well as the Group’s equity due to the allocation<br />

of translation differences to the currency reserve in equity. Since the foreign group companies enjoy a high degree<br />

of autonomy within their respective functional currency areas in terms of their operating and financial activities, fluctuations<br />

in exchange rates effectively do not present any significant liquidity risk for the Group.<br />

By analogy with the foreign companies, the parent company also performs the predominant share of its operating activities<br />

in its functional currency (u). The foreign currency risk faced by the <strong>STRATEC</strong> Group on account of its operating<br />

activities is therefore classified as low.<br />

To present market risks, IFRS 7 requires companies to perform sensitivity analyses portraying the impact of hypothetical<br />

changes in the relevant risk variables on their earnings and equity. The implications for the period under report are determined<br />

by applying these hypothetical changes in variables to the volumes of financial instruments held at the balance<br />

sheet date.<br />

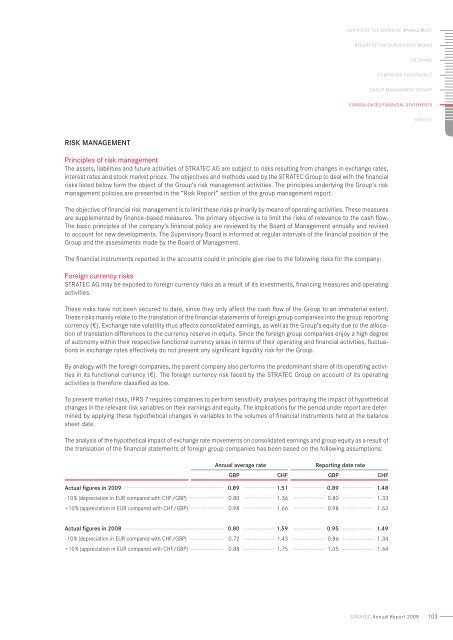

The analysis of the hypothetical impact of exchange rate movements on consolidated earnings and group equity as a result of<br />

the translation of the financial statements of foreign group companies has been based on the following assumptions:<br />

Annual average rate<br />

<strong>Report</strong>ing date rate<br />

GBP CHF GBP CHF<br />

Actual figures in <strong>2009</strong> 0.89 1.51 0.89 1.48<br />

- 10 % (depreciation in EUR compared with CHF/GBP) 0.80 1.36 0.80 1.33<br />

+ 10 % (appreciation in EUR compared with CHF/GBP) 0.98 1.66 0.98 1.63<br />

Actual figures in 2008 0.80 1.59 0.95 1.49<br />

- 10 % (depreciation in EUR compared with CHF/GBP) 0.72 1.43 0.86 1.34<br />

+ 10 % (appreciation in EUR compared with CHF/GBP) 0.88 1.75 1.05 1.64<br />

stratec Annual <strong>Report</strong> <strong>2009</strong><br />

103