annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong> of the board of Management<br />

<strong>Report</strong> of the supervisory board<br />

THE share<br />

Corporate Governance<br />

Group Management report<br />

Consolidated financial statements<br />

Service<br />

Liquid funds are invested solely in the form of short-term deposits (with maximum terms of three months) at financial<br />

institutions with high-quality ratings.<br />

The maximum default risk is reflected on the one hand by the carrying amount of the financial assets reported in the<br />

balance sheet. However, these figures do not account for the hedging measures outlined above.<br />

Derivative financial instruments not hedging a hedged item are classified as trading financial instruments and measured at fair<br />

value as of the balance sheet date. Any differences between cost and fair value are recognized through profit or loss.<br />

Derivative financial instruments hedging a hedged item, such as those deployed to hedge against currency and interest<br />

rate risks, are recognized through profit or loss or in equity depending on whether the hedge in question is intended to<br />

secure the fair value or the future cash flow.<br />

Capital management<br />

Capital management at <strong>STRATEC</strong> <strong>AG</strong> pursues the primary objective of maintaining the company’s financial substance<br />

and safeguarding its debt servicing capacity.<br />

In monitoring its achievement of these objectives, the management refers to the equity ratio and the ratio of financial<br />

receivables to financial liabilities.<br />

The equity ratio amounted to 69.1 % as of December 31, <strong>2009</strong>, and was thus only slightly lower than in the previous year<br />

(71.3 %). The target range for this figure amounts to 50 % to 75 %.<br />

The ratio of current financial assets to current financial liabilities amounted to 2.2 as of December 31, <strong>2009</strong>, compared<br />

with 2.9 in the previous year. This ratio should not fall short of 1.5.<br />

<strong>STRATEC</strong> bases its calculation of current financial assets on receivables and other assets, securities and cash and cash<br />

equivalents.<br />

The internal assessment of the company’s debt servicing capacity is based on the ratio of current and non-current financial<br />

liabilities to the company’s actual cash flow during the financial year, plus the cash flows budgeted for the following<br />

two years.<br />

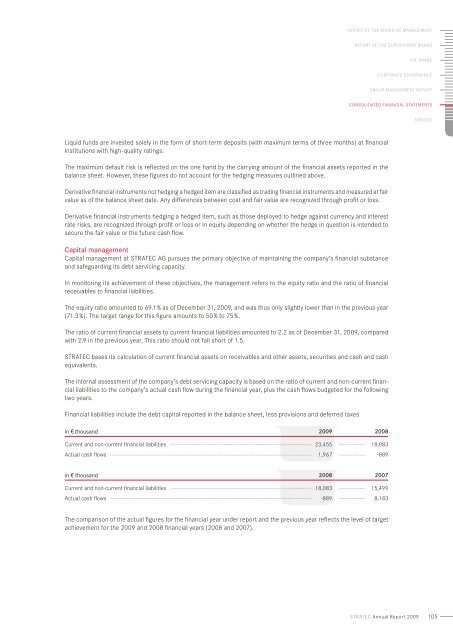

Financial liabilities include the debt capital reported in the balance sheet, less provisions and deferred taxes<br />

in v thousand <strong>2009</strong> 2008<br />

Current and non-current financial liabilities 23,455 18,083<br />

Actual cash flows 1,967 -889<br />

in v thousand 2008 2007<br />

Current and non-current financial liabilities 18,083 15,499<br />

Actual cash flows -889 8,183<br />

The comparison of the actual figures for the financial year under report and the previous year reflects the level of target<br />

achievement for the <strong>2009</strong> and 2008 financial years (2008 and 2007).<br />

stratec Annual <strong>Report</strong> <strong>2009</strong><br />

105