annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong> of the board of Management<br />

<strong>Report</strong> of the supervisory board<br />

THE share<br />

Corporate Governance<br />

Group Management report<br />

Consolidated financial statements<br />

Service<br />

4. Accounting and valuation principles<br />

Goodwill<br />

Goodwill resulting from capital consolidation is not subject to scheduled amortization, but is rather assessed for impairment<br />

pursuant to IFRS 3 <strong>annual</strong>ly or upon occurrence of any significant event or change in circumstances (impairment<br />

test). Should any impairment be identified, then the amount recognized in the balance sheet must be adjusted through<br />

profit or loss.<br />

For the purpose of impairment tests, the goodwill resulting from the acquisition of Sanguin International Ltd. continues<br />

to be allocated to the “Sanguin Group” cash generating unit (CGU). The carrying amount of the goodwill accounts for a<br />

material share of the total carrying amount. In addition to goodwill, the total carrying amount includes other intangible<br />

assets (software) identified upon purchase price allocation and the shareholding held in Sanguin International Inc.,<br />

Hamden, USA, (financial asset with direct relevance to services rendered).<br />

The recoverable amount of the unit has been calculated on the basis of its use value. Use values have been based on<br />

the future cash flows of the cash generating units determined using the discounted cash flow method. The cash flow<br />

forecasts are based on a detailed budget period of three years. They are calculated on a pre-tax basis at a discount rate<br />

of 8.56 % (previous year: 9.14 %). Cash flows beyond the detailed budget period are presented as perpetuity based on<br />

a free cash flow growth rate of 0.5 % (previous year: 5 %). This growth rate reflects the estimates made by the Board of<br />

Management and local management.<br />

The basis for determining the value of the underlying assumptions is as follows:<br />

Budgeted sales<br />

Based on historic values and market potential as assessed by the Board of Management and local management.<br />

Development in exchange rates<br />

Currency fluctuations are not expected to have any material implications for impairment tests.<br />

Budgeted margins<br />

Margins achieved in the past, taking due account of further efficiency enhancements based on increases already<br />

achieved.<br />

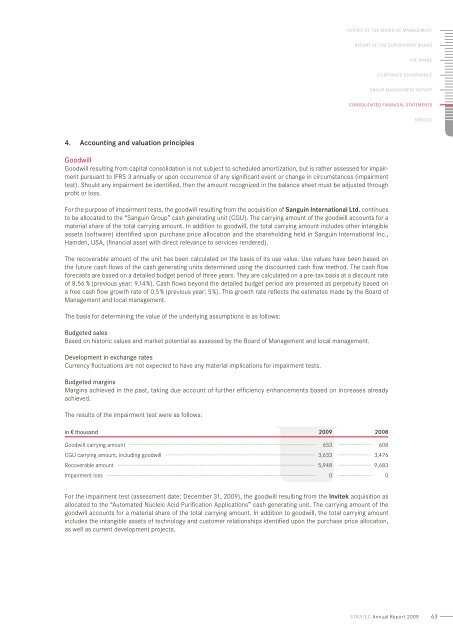

The results of the impairment test were as follows:<br />

in v thousand <strong>2009</strong> 2008<br />

Goodwill carrying amount 653 608<br />

CGU carrying amount, including goodwill 3,633 3,476<br />

Recoverable amount 5,948 9,683<br />

Impairment loss 0 0<br />

For the impairment test (assessment date: December 31, <strong>2009</strong>), the goodwill resulting from the Invitek acquisition as<br />

allocated to the “Automated Nucleic Acid Purification Applications” cash generating unit. The carrying amount of the<br />

goodwill accounts for a material share of the total carrying amount. In addition to goodwill, the total carrying amount<br />

includes the intangible assets of technology and customer relationships identified upon the purchase price allocation,<br />

as well as current development projects.<br />

stratec Annual <strong>Report</strong> <strong>2009</strong><br />

63