annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

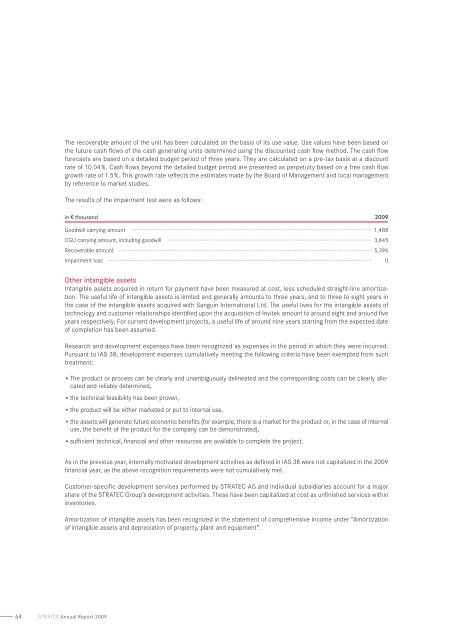

The recoverable amount of the unit has been calculated on the basis of its use value. Use values have been based on<br />

the future cash flows of the cash generating units determined using the discounted cash flow method. The cash flow<br />

forecasts are based on a detailed budget period of three years. They are calculated on a pre-tax basis at a discount<br />

rate of 10.04 %. Cash flows beyond the detailed budget period are presented as perpetuity based on a free cash flow<br />

growth rate of 1.5 %. This growth rate reflects the estimates made by the Board of Management and local management<br />

by reference to market studies.<br />

The results of the impairment test were as follows:<br />

in v thousand <strong>2009</strong><br />

Goodwill carrying amount 1,488<br />

CGU carrying amount, including goodwill 3,845<br />

Recoverable amount 5,396<br />

Impairment loss 0<br />

Other intangible assets<br />

Intangible assets acquired in return for payment have been measured at cost, less scheduled straight-line amortization.<br />

The useful life of intangible assets is limited and generally amounts to three years, and to three to eight years in<br />

the case of the intangible assets acquired with Sanguin International Ltd. The useful lives for the intangible assets of<br />

technology and customer relationships identified upon the acquisition of Invitek amount to around eight and around five<br />

years respectively. For current development projects, a useful life of around nine years starting from the expected date<br />

of completion has been assumed.<br />

Research and development expenses have been recognized as expenses in the period in which they were incurred.<br />

Pursuant to IAS 38, development expenses cumulatively meeting the following criteria have been exempted from such<br />

treatment:<br />

• The product or process can be clearly and unambiguously delineated and the corresponding costs can be clearly allocated<br />

and reliably determined,<br />

• the technical feasibility has been proven,<br />

• the product will be either marketed or put to internal use,<br />

• the assets will generate future economic benefits (for example, there is a market for the product or, in the case of internal<br />

use, the benefit of the product for the company can be demonstrated),<br />

• sufficient technical, financial and other resources are available to complete the project.<br />

As in the previous year, internally motivated development activities as defined in IAS 38 were not capitalized in the <strong>2009</strong><br />

financial year, as the above recognition requirements were not cumulatively met.<br />

Customer-specific development services performed by <strong>STRATEC</strong> <strong>AG</strong> and individual subsidiaries account for a major<br />

share of the <strong>STRATEC</strong> Group’s development activities. These have been capitalized at cost as unfinished services within<br />

inventories.<br />

Amortization of intangible assets has been recognized in the statement of comprehensive income under “Amortization<br />

of intangible assets and depreciation of property, plant and equipment”.<br />

64 stratec Annual <strong>Report</strong> <strong>2009</strong>