annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong> of the board of Management<br />

<strong>Report</strong> of the supervisory board<br />

THE share<br />

Corporate Governance<br />

Group Management report<br />

Consolidated financial statements<br />

Service<br />

The shares granted have been measured at their market price on the acquisition date. The conditional purchase price<br />

component (u 230 thousand) is dependent on the achievement of specified sales targets, as well as on the achievement of<br />

specified milestones in five research and development projects at Invitek. The performance date set for the achievement<br />

of these targets was December 31, <strong>2009</strong>. Accordingly, the disclosure of a range of conditional events has been foregone,<br />

as these could be reliably determined at the balance sheet date and there was no uncertainty in this respect.<br />

The Invitek acquisition has been recognized in the cash flow statement for the <strong>2009</strong> financial year by recognition of an<br />

amount of u 1,738 thousand in the cash flow from investment activities. This corresponds to the purchase price paid<br />

(u 1,745 thousand), less the cash and cash equivalents taken over at Invitek (u 7 thousand).<br />

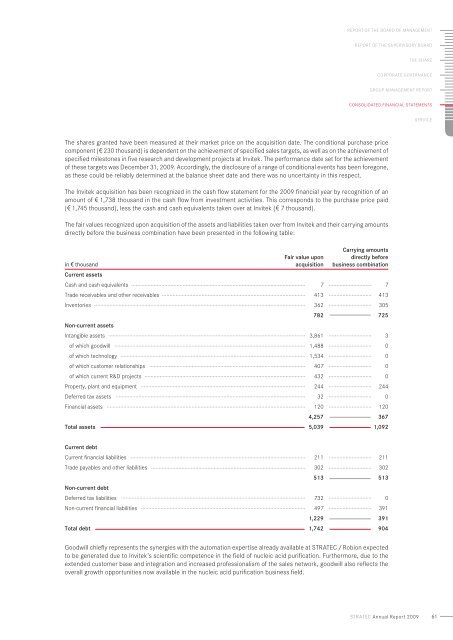

The fair values recognized upon acquisition of the assets and liabilities taken over from Invitek and their carrying amounts<br />

directly before the business combination have been presented in the following table:<br />

in v thousand<br />

Fair value upon<br />

acquisition<br />

Carrying amounts<br />

directly before<br />

business combination<br />

Current assets<br />

Cash and cash equivalents 7 7<br />

Trade receivables and other receivables 413 413<br />

Inventories 362 305<br />

782 725<br />

Non-current assets<br />

Intangible assets 3,861 3<br />

of which goodwill 1,488 0<br />

of which technology 1,534 0<br />

of which customer relationships 407 0<br />

of which current R&D projects 432 0<br />

Property, plant and equipment 244 244<br />

Deferred tax assets 32 0<br />

Financial assets 120 120<br />

4,257 367<br />

Total assets 5,039 1,092<br />

Current debt<br />

Current financial liabilities 211 211<br />

Trade payables and other liabilities 302 302<br />

513 513<br />

Non-current debt<br />

Deferred tax liabilities 732 0<br />

Non-current financial liabilities 497 391<br />

1,229 391<br />

Total debt 1,742 904<br />

Goodwill chiefly represents the synergies with the automation expertise already available at <strong>STRATEC</strong> / Robion expected<br />

to be generated due to Invitek’s scientific competence in the field of nucleic acid purification. Furthermore, due to the<br />

extended customer base and integration and increased professionalism of the sales network, goodwill also reflects the<br />

overall growth opportunities now available in the nucleic acid purification business field.<br />

stratec Annual <strong>Report</strong> <strong>2009</strong><br />

61