Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the financial statements<br />

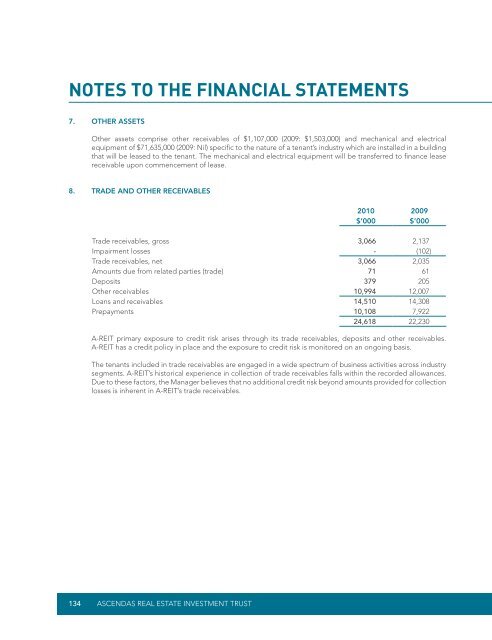

7. Other assets<br />

Other assets comprise other receivables of $1,107,000 (2009: $1,503,000) and mechanical and electrical<br />

equipment of $71,635,000 (2009: Nil) specific to the nature of a tenant’s industry which are installed in a building<br />

that will be leased to the tenant. The mechanical and electrical equipment will be transferred to finance lease<br />

receivable upon commencement of lease.<br />

8. Trade and other receivables<br />

2010 2009<br />

$’000 $’000<br />

Trade receivables, gross 3,066 2,137<br />

Impairment losses - (102)<br />

Trade receivables, net 3,066 2,035<br />

Amounts due from related parties (trade) 71 61<br />

Deposits 379 205<br />

Other receivables 10,994 12,007<br />

Loans and receivables 14,510 14,308<br />

Prepayments 10,108 7,922<br />

24,618 22,230<br />

A-<strong>REIT</strong> primary exposure to credit risk arises through its trade receivables, deposits and other receivables.<br />

A-<strong>REIT</strong> has a credit policy in place and the exposure to credit risk is monitored on an ongoing basis.<br />

The tenants included in trade receivables are engaged in a wide spectrum of business activities across industry<br />

segments. A-<strong>REIT</strong>’s historical experience in collection of trade receivables falls within the recorded allowances.<br />

Due to these factors, the Manager believes that no additional credit risk beyond amounts provided for collection<br />

losses is inherent in A-<strong>REIT</strong>’s trade receivables.<br />

134 <strong>Ascendas</strong> real estate investment trust