Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

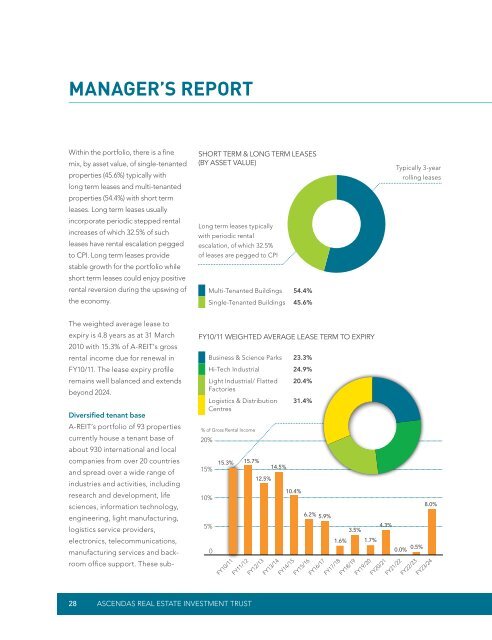

MANAGER’S REPORT<br />

Within the portfolio, there is a fine<br />

mix, by asset value, of single-tenanted<br />

properties (45.6%) typically with<br />

long term leases and multi-tenanted<br />

properties (54.4%) with short term<br />

leases. Long term leases usually<br />

incorporate periodic stepped rental<br />

increases of which 32.5% of such<br />

leases have rental escalation pegged<br />

to CPI. Long term leases provide<br />

stable growth for the portfolio while<br />

short term leases could enjoy positive<br />

rental reversion during the upswing of<br />

the economy.<br />

Short term & long term leases<br />

(by Asset Value)<br />

Long term leases typically<br />

with periodic rental<br />

escalation, of which 32.5%<br />

of leases are pegged to CPI<br />

Multi-Tenanted Buildings 54.4%<br />

Single-Tenanted Buildings 45.6%<br />

Typically 3-year<br />

rolling leases<br />

The weighted average lease to<br />

expiry is 4.8 years as at 31 March<br />

2010 with 15.3% of A-<strong>REIT</strong>’s gross<br />

rental income due for renewal in<br />

FY10/11. The lease expiry profile<br />

remains well balanced and extends<br />

beyond 2024.<br />

Diversified tenant base<br />

A-<strong>REIT</strong>’s portfolio of 93 properties<br />

currently house a tenant base of<br />

about 930 international and local<br />

companies from over 20 countries<br />

and spread over a wide range of<br />

industries and activities, including<br />

research and development, life<br />

sciences, information technology,<br />

engineering, light manufacturing,<br />

logistics service providers,<br />

electronics, telecommunications,<br />

manufacturing services and backroom<br />

office support. These sub-<br />

FY10/11 Weighted Average Lease Term to Expiry<br />

20%<br />

15%<br />

10%<br />

5%<br />

Business & Science Parks 23.3%<br />

Hi-Tech Industrial 24.9%<br />

Light Industrial/ Flatted<br />

Factories<br />

Logistics & Distribution<br />

Centres<br />

% of Gross Rental Income<br />

0<br />

15.3%<br />

FY10/11<br />

FY11/12<br />

15.7%<br />

12.5%<br />

FY12/13<br />

14.5%<br />

FY13/14<br />

10.4%<br />

FY14/15<br />

20.4%<br />

31.4%<br />

FY15/16<br />

6.2% 5.9%<br />

1.6%<br />

FY16/17<br />

FY17/18<br />

3.5%<br />

FY18/19<br />

1.7%<br />

FY19/20<br />

4.3%<br />

FY20/21<br />

0.0% 0.5% 8.0%<br />

FY21/22<br />

FY22/23<br />

FY23/24<br />

28 <strong>Ascendas</strong> real estate investment trust