Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the financial statements<br />

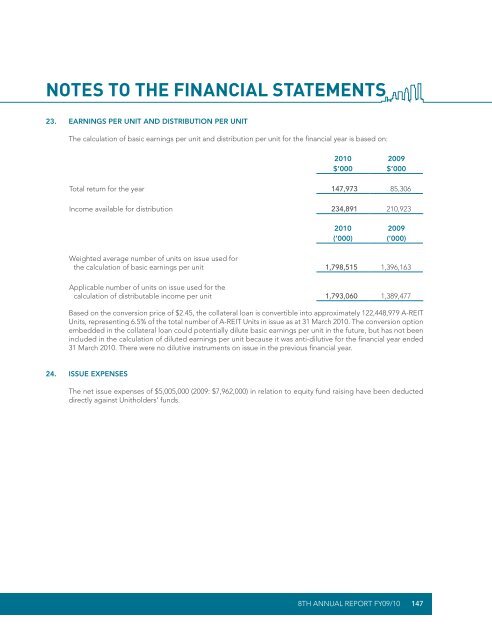

23. Earnings per unit and distribution per unit<br />

The calculation of basic earnings per unit and distribution per unit for the financial year is based on:<br />

2010 2009<br />

$’000 $’000<br />

Total return for the year 147,973 85,306<br />

Income available for distribution 234,891 210,923<br />

2010 2009<br />

(’000) (’000)<br />

Weighted average number of units on issue used for<br />

the calculation of basic earnings per unit 1,798,515 1,396,163<br />

Applicable number of units on issue used for the<br />

calculation of distributable income per unit 1,793,060 1,389,477<br />

Based on the conversion price of $2.45, the collateral loan is convertible into approximately 122,448,979 A-<strong>REIT</strong><br />

Units, representing 6.5% of the total number of A-<strong>REIT</strong> Units in issue as at 31 March 2010. The conversion option<br />

embedded in the collateral loan could potentially dilute basic earnings per unit in the future, but has not been<br />

included in the calculation of diluted earnings per unit because it was anti-dilutive for the financial year ended<br />

31 March 2010. There were no dilutive instruments on issue in the previous financial year.<br />

24. Issue expenses<br />

The net issue expenses of $5,005,000 (2009: $7,962,000) in relation to equity fund raising have been deducted<br />

directly against Unitholders’ funds.<br />

8th Annual <strong>Report</strong> FY09/10<br />

147