Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

Download Full Report - Ascendas REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

was in view of the significant<br />

amount of refinancing expected<br />

in the Singapore <strong>REIT</strong>s sector in<br />

2012. 23 properties worth about<br />

S$1,223.4m were released from<br />

the security pool<br />

• Issuance of the first ever S$300m<br />

ECS due 2017 with a put option<br />

in 2015 at a coupon of 1.6% p.a.<br />

and exchange price of S$2.45<br />

which was over 50% premium<br />

over A-<strong>REIT</strong>’s current NAV.<br />

19 properties worth about<br />

S$935.2m were provided as<br />

security for the ECS<br />

• Extension of a S$300m term<br />

loan due in March 2010 by 7<br />

years to March 2017<br />

The ECS, which was rated “AAA”<br />

by S&P and “Aaa” by Moody’s,<br />

has allowed A-<strong>REIT</strong> to diversify<br />

its sources of debt financing. With<br />

a quality underlying portfolio and<br />

an understanding of investors’<br />

needs, the Manager was able to<br />

tap a new investor base in the<br />

international capital markets and<br />

obtain very competitive mediumterm<br />

debt financing.<br />

Consequently, A-<strong>REIT</strong>’s weighted<br />

average debt maturity was extended<br />

from 2.2 years to 4.0 years.<br />

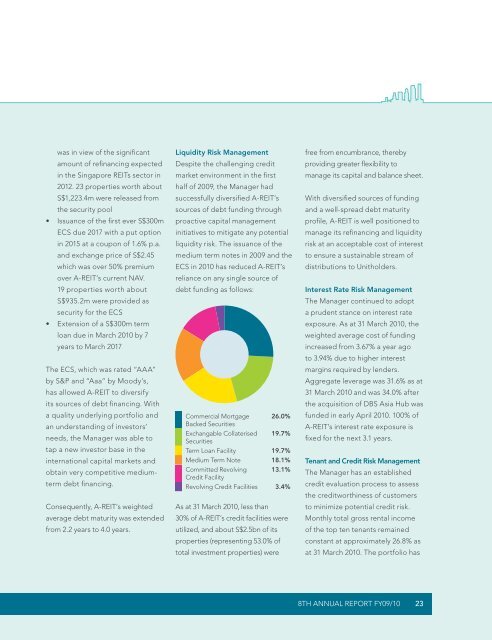

Liquidity Risk Management<br />

Despite the challenging credit<br />

market environment in the first<br />

half of 2009, the Manager had<br />

successfully diversified A-<strong>REIT</strong>’s<br />

sources of debt funding through<br />

proactive capital management<br />

initiatives to mitigate any potential<br />

liquidity risk. The issuance of the<br />

medium term notes in 2009 and the<br />

ECS in 2010 has reduced A-<strong>REIT</strong>’s<br />

reliance on any single source of<br />

debt funding as follows:<br />

Commercial Mortgage 26.0%<br />

Backed Securities<br />

Exchangable Collaterised 19.7%<br />

Securities<br />

Term Loan Facility 19.7%<br />

Medium Term Note 18.1%<br />

Committed Revolving 13.1%<br />

Credit Facility<br />

Revolving Credit Facilities 3.4%<br />

As at 31 March 2010, less than<br />

30% of A-<strong>REIT</strong>’s credit facilities were<br />

utilized, and about S$2.5bn of its<br />

properties (representing 53.0% of<br />

total investment properties) were<br />

free from encumbrance, thereby<br />

providing greater flexibility to<br />

manage its capital and balance sheet.<br />

With diversified sources of funding<br />

and a well-spread debt maturity<br />

profile, A-<strong>REIT</strong> is well positioned to<br />

manage its refinancing and liquidity<br />

risk at an acceptable cost of interest<br />

to ensure a sustainable stream of<br />

distributions to Unitholders.<br />

Interest Rate Risk Management<br />

The Manager continued to adopt<br />

a prudent stance on interest rate<br />

exposure. As at 31 March 2010, the<br />

weighted average cost of funding<br />

increased from 3.67% a year ago<br />

to 3.94% due to higher interest<br />

margins required by lenders.<br />

Aggregate leverage was 31.6% as at<br />

31 March 2010 and was 34.0% after<br />

the acquisition of DBS Asia Hub was<br />

funded in early April 2010. 100% of<br />

A-<strong>REIT</strong>’s interest rate exposure is<br />

fixed for the next 3.1 years.<br />

Tenant and Credit Risk Management<br />

The Manager has an established<br />

credit evaluation process to assess<br />

the creditworthiness of customers<br />

to minimize potential credit risk.<br />

Monthly total gross rental income<br />

of the top ten tenants remained<br />

constant at approximately 26.8% as<br />

at 31 March 2010. The portfolio has<br />

8th Annual <strong>Report</strong> FY09/10<br />

23