Part D â Understanding and improving industry performance (PDF ...

Part D â Understanding and improving industry performance (PDF ...

Part D â Understanding and improving industry performance (PDF ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Taxi assignment market share by broker type, 2009 to 2011<br />

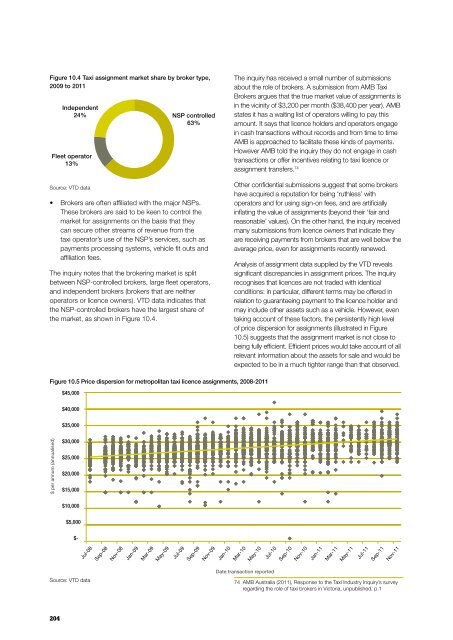

Figure 10.4 Taxi assignment market share by broker type,<br />

2009 to 2011<br />

Independent<br />

24%<br />

Fleet operator<br />

13%<br />

NSP controlled<br />

63%<br />

The inquiry has received a small number of submissions<br />

about the role of brokers. A submission from AMB Taxi<br />

Brokers argues that the true market value of assignments is<br />

in the vicinity of $3,200 per month ($38,400 per year). AMB<br />

states it has a waiting list of operators willing to pay this<br />

amount. It says that licence holders <strong>and</strong> operators engage<br />

in cash transactions without records <strong>and</strong> from time to time<br />

AMB is approached to facilitate these kinds of payments.<br />

However AMB told the inquiry they do not engage in cash<br />

transactions or offer incentives relating to taxi licence or<br />

assignment transfers. 74<br />

Source: VTD data<br />

• Brokers are often affiliated with the major NSPs.<br />

These brokers are said to be keen to control the<br />

market for assignments on the basis that they<br />

can secure other streams of revenue from the<br />

taxi operator’s use of the NSP’s services, such as<br />

payments processing systems, vehicle fit outs <strong>and</strong><br />

affiliation fees.<br />

The inquiry notes that the brokering market is split<br />

between NSP-controlled brokers, large fleet operators,<br />

<strong>and</strong> independent brokers (brokers that are neither<br />

operators or licence owners). VTD data indicates that<br />

the NSP-controlled brokers have the largest share of<br />

the market, as shown in Figure 10.4.<br />

Figure E1 Price dispersion for metropolitan taxi licence assignments, 2008-2011<br />

Figure 10.5 Price dispersion for metropolitan taxi licence assignments, 2008-2011<br />

$45,000<br />

Other confidential submissions suggest that some brokers<br />

have acquired a reputation for being ‘ruthless’ with<br />

operators <strong>and</strong> for using sign-on fees, <strong>and</strong> are artificially<br />

inflating the value of assignments (beyond their ‘fair <strong>and</strong><br />

reasonable’ values). On the other h<strong>and</strong>, the inquiry received<br />

many submissions from licence owners that indicate they<br />

are receiving payments from brokers that are well below the<br />

average price, even for assignments recently renewed.<br />

Analysis of assignment data supplied by the VTD reveals<br />

significant discrepancies in assignment prices. The inquiry<br />

recognises that licences are not traded with identical<br />

conditions: in particular, different terms may be offered in<br />

relation to guaranteeing payment to the licence holder <strong>and</strong><br />

may include other assets such as a vehicle. However, even<br />

taking account of these factors, the persistently high level<br />

of price dispersion for assignments (illustrated in Figure<br />

10.5) suggests that the assignment market is not close to<br />

being fully efficient. Efficient prices would take account of all<br />

relevant information about the assets for sale <strong>and</strong> would be<br />

expected to be in a much tighter range than that observed.<br />

$40,000<br />

$35,000<br />

$ per annum (annualised)<br />

$30,000<br />

$25,000<br />

$20,000<br />

$15,000<br />

$10,000<br />

$5,000<br />

$-<br />

Jul-08<br />

Sep-08<br />

Nov-08<br />

Jan-09<br />

Mar-09<br />

May-09<br />

Jul-09<br />

Sep-09<br />

Nov-09<br />

Jan-10<br />

Mar-10<br />

May-10<br />

Jul-10<br />

Sep-10<br />

Nov-10<br />

Jan-11<br />

Mar-11<br />

May-11<br />

Jul-11<br />

Sep-11<br />

Nov-11<br />

Source: VTD data<br />

Date transaction reported<br />

74 AMB Australia (2011), Response to the Taxi Industry Inquiry’s survey<br />

regarding the role of taxi brokers in Victoria, unpublished, p.1<br />

204