Part D â Understanding and improving industry performance (PDF ...

Part D â Understanding and improving industry performance (PDF ...

Part D â Understanding and improving industry performance (PDF ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

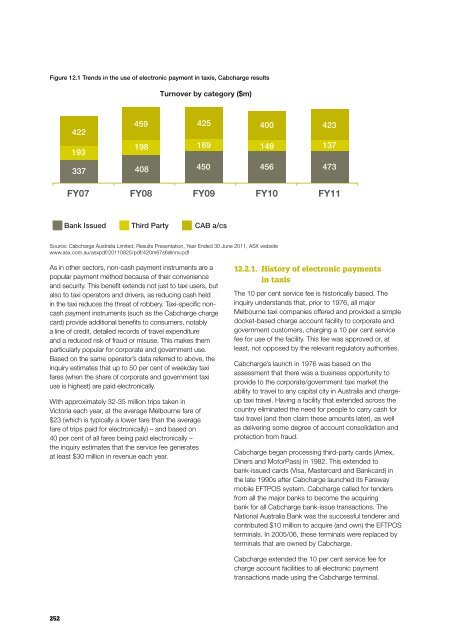

Figure 12.1 Trends in the use of electronic payment in taxis, Cabcharge results<br />

Figure 12.1 Trends in the use of electronic payment in taxis, Cabcharge results<br />

Turnover by category ($m)<br />

422<br />

193<br />

459<br />

198<br />

425<br />

169<br />

400<br />

149<br />

423<br />

137<br />

337<br />

408<br />

450<br />

456<br />

473<br />

FY07 FY08 FY09 FY10 FY11<br />

Bank Issued Third <strong>Part</strong>y CAB a/cs<br />

Source: Cabcharge Australia Limited, Results Presentation, Year Ended 30 June 2011, ASX website<br />

www.asx.com.au/asxpdf/20110825/pdf/420m67s6sllnnv.pdf<br />

As in other sectors, non-cash payment instruments are a<br />

popular payment method because of their convenience<br />

<strong>and</strong> security. This benefit extends not just to taxi users, but<br />

also to taxi operators <strong>and</strong> drivers, as reducing cash held<br />

in the taxi reduces the threat of robbery. Taxi-specific noncash<br />

payment instruments (such as the Cabcharge charge<br />

card) provide additional benefits to consumers, notably<br />

a line of credit, detailed records of travel expenditure<br />

<strong>and</strong> a reduced risk of fraud or misuse. This makes them<br />

particularly popular for corporate <strong>and</strong> government use.<br />

Based on the same operator’s data referred to above, the<br />

inquiry estimates that up to 50 per cent of weekday taxi<br />

fares (when the share of corporate <strong>and</strong> government taxi<br />

use is highest) are paid electronically.<br />

With approximately 32-35 million trips taken in<br />

Victoria each year, at the average Melbourne fare of<br />

$23 (which is typically a lower fare than the average<br />

fare of trips paid for electronically) – <strong>and</strong> based on<br />

40 per cent of all fares being paid electronically –<br />

the inquiry estimates that the service fee generates<br />

at least $30 million in revenue each year.<br />

12.2.1. History of electronic payments<br />

in taxis<br />

The 10 per cent service fee is historically based. The<br />

inquiry underst<strong>and</strong>s that, prior to 1976, all major<br />

Melbourne taxi companies offered <strong>and</strong> provided a simple<br />

docket-based charge account facility to corporate <strong>and</strong><br />

government customers, charging a 10 per cent service<br />

fee for use of the facility. This fee was approved or, at<br />

least, not opposed by the relevant regulatory authorities.<br />

Cabcharge’s launch in 1976 was based on the<br />

assessment that there was a business opportunity to<br />

provide to the corporate/government taxi market the<br />

ability to travel to any capital city in Australia <strong>and</strong> chargeup<br />

taxi travel. Having a facility that extended across the<br />

country eliminated the need for people to carry cash for<br />

taxi travel (<strong>and</strong> then claim these amounts later), as well<br />

as delivering some degree of account consolidation <strong>and</strong><br />

protection from fraud.<br />

Cabcharge began processing third-party cards (Amex,<br />

Diners <strong>and</strong> MotorPass) in 1982. This extended to<br />

bank-issued cards (Visa, Mastercard <strong>and</strong> Bankcard) in<br />

the late 1990s after Cabcharge launched its Fareway<br />

mobile EFTPOS system. Cabcharge called for tenders<br />

from all the major banks to become the acquiring<br />

bank for all Cabcharge bank-issue transactions. The<br />

National Australia Bank was the successful tenderer <strong>and</strong><br />

contributed $10 million to acquire (<strong>and</strong> own) the EFTPOS<br />

terminals. In 2005/06, these terminals were replaced by<br />

terminals that are owned by Cabcharge.<br />

Cabcharge extended the 10 per cent service fee for<br />

charge account facilities to all electronic payment<br />

transactions made using the Cabcharge terminal.<br />

252