2005 Annual report - Virbac

2005 Annual report - Virbac

2005 Annual report - Virbac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

31<br />

❖ Equine<br />

Equine products closed the year up 6.2%, in particular thanks<br />

to the launch of Equimax ® in France (broad-spectrum wormer<br />

for horses) and the introduction of new packaging in other<br />

countries.<br />

❖ Specialised petfood<br />

In <strong>2005</strong>, this business continued to gain market share, rising<br />

by 2.1% on 2004. This change is down to the growth of the<br />

<strong>Virbac</strong> Vet Complex ® range in France in a market that is growing<br />

at veterinary clinics, but also the launch of the range in<br />

Japan, Korea, Spain and New Zealand.<br />

❖ Electronic identification<br />

Following spectacular growth in 2004, this segment saw a<br />

decline in sales in <strong>2005</strong> of –13.2% at constant exchange<br />

rates. This business had enjoyed a one-off impulse in 2004<br />

from the discovery of a case of canine rabies in southwest<br />

France, which had driven owners to identify their animals.<br />

Food producing animals<br />

This business accounts for 32.5% of Group sales and grew<br />

by 2.2% at constant exchange rates in <strong>2005</strong>.<br />

❖ Bovine parasiticides<br />

This range was down 4.4% on 2004 following the decision<br />

of the US subsidiary to pull out of the generic bovine<br />

parasiticides market in the US.<br />

Major events during the year:<br />

- the launch of a full range of bovine parasiticides<br />

(ivermectin-based parasiticides) in France at the end<br />

of September <strong>2005</strong>,<br />

- the launch of Virbamec ® F (bovine parasiticide)<br />

in the United Kingdom and Spain.<br />

❖ Other bovine products<br />

These products grew 5.7% in <strong>2005</strong> with strong performance<br />

across the whole business. In Europe, the Shotapen ®<br />

antibiotic (antibiotic against bovine respiratory complaints)<br />

which was re-registered with the regulatory authorities in<br />

2004, performed extremely well. In Australia, growth largely<br />

stemmed from the sales generated under a distribution<br />

agreement with Intervet.<br />

❖ Pig and poultry antibiotics<br />

Following a decline in 2004, this segment grew by 1.5% in<br />

<strong>2005</strong> with performance varying between regions. A decline<br />

in Europe apart from Greece, strong growth in South Africa<br />

where the subsidiary performed very well on the back of<br />

sales of Pulmodox ® POS (oral antibiotic for the treatment of<br />

respiratory infections in pigs), recovery in Asia following<br />

a decline in 2004.<br />

❖ Other pig and poultry products<br />

These products declined slightly.<br />

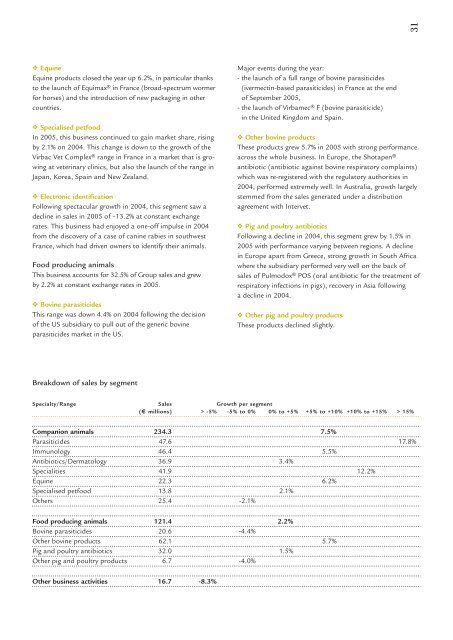

Breakdown of sales by segment<br />

Specialty/Range Sales Growth per segment<br />

(€ millions) > -5% -5% to 0% 0% to +5% +5% to +10% +10% to +15% > 15%<br />

Companion animals 234.3 7.5%<br />

Parasiticides 47.6 17.8%<br />

Immunology 46.4 5.5%<br />

Antibiotics/Dermatology 36.9 3.4%<br />

Specialities 41.9 12.2%<br />

Equine 22.3 6.2%<br />

Specialised petfood 13.8 2.1%<br />

Others 25.4 -2.1%<br />

Food producing animals 121.4 2.2%<br />

Bovine parasiticides 20.6 -4.4%<br />

Other bovine products 62.1 5.7%<br />

Pig and poultry antibiotics 32.0 1.5%<br />

Other pig and poultry products 6.7 -4.0%<br />

Other business activities 16.7 -8.3%