2005 Annual report - Virbac

2005 Annual report - Virbac

2005 Annual report - Virbac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

91<br />

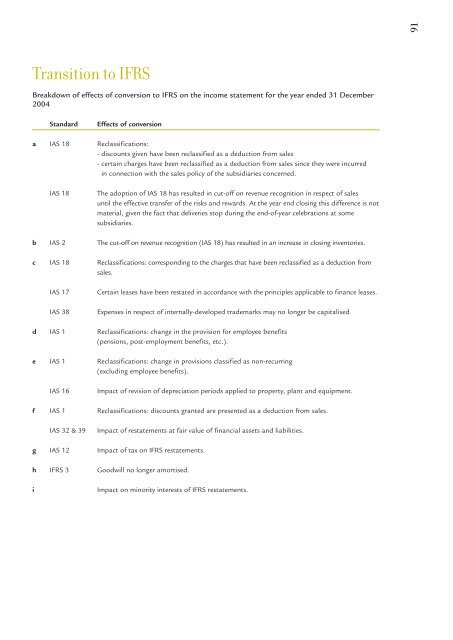

Transition to IFRS<br />

Breakdown of effects of conversion to IFRS on the income statement for the year ended 31 December<br />

2004<br />

Standard<br />

Effects of conversion<br />

a IAS 18 Reclassifications:<br />

- discounts given have been reclassified as a deduction from sales<br />

- certain charges have been reclassified as a deduction from sales since they were incurred<br />

in connection with the sales policy of the subsidiaries concerned.<br />

IAS 18<br />

The adoption of IAS 18 has resulted in cut-off on revenue recognition in respect of sales<br />

until the effective transfer of the risks and rewards. At the year end closing this difference is not<br />

material, given the fact that deliveries stop during the end-of-year celebrations at some<br />

subsidiaries.<br />

b IAS 2 The cut-off on revenue recognition (IAS 18) has resulted in an increase in closing inventories.<br />

c IAS 18 Reclassifications: corresponding to the charges that have been reclassified as a deduction from<br />

sales.<br />

IAS 17<br />

IAS 38<br />

Certain leases have been restated in accordance with the principles applicable to finance leases.<br />

Expenses in respect of internally-developed trademarks may no longer be capitalised.<br />

d IAS 1 Reclassifications: change in the provision for employee benefits<br />

(pensions, post-employment benefits, etc.).<br />

e IAS 1 Reclassifications: change in provisions classified as non-recurring<br />

(excluding employee benefits).<br />

IAS 16<br />

Impact of revision of depreciation periods applied to property, plant and equipment.<br />

f IAS 1 Reclassifications: discounts granted are presented as a deduction from sales.<br />

IAS 32 & 39<br />

Impact of restatements at fair value of financial assets and liabilities.<br />

g IAS 12 Impact of tax on IFRS restatements.<br />

h IFRS 3 Goodwill no longer amortised.<br />

i<br />

Impact on minority interests of IFRS restatements.