2005 Annual report - Virbac

2005 Annual report - Virbac

2005 Annual report - Virbac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

48<br />

The combination of these two ratios in order to calculate<br />

the share in the profits has the twin goal of:<br />

◆ giving employees a share in the profits that is in line with<br />

the company’s financial performance (ratio based on net<br />

profit), and<br />

◆ rewarding the collective contribution of employees (ratio<br />

based on operating profit).<br />

The second novelty is a top-up by the company where the<br />

profit share is paid into the company savings plan (PEE)<br />

(top-up equal to 25% of the bonus) and into the collective<br />

retirement savings plan (PERCO) (top-up equal to 50% of<br />

the bonus).<br />

❖ Employee profit-sharing in company net profit<br />

Employee profit-sharing in a company’s net profit is<br />

mandatory in companies with over fifty employees and has<br />

been in place in <strong>Virbac</strong> since 1987.<br />

A Group profit-sharing agreement covering <strong>Virbac</strong>, <strong>Virbac</strong><br />

Distribution, <strong>Virbac</strong> France, Francodex and Alfamed is in<br />

force. Each Group company contributes to building up a<br />

general reserve for the total amount of its own reserve,<br />

calculated using the legally prescribed formula.<br />

The profit-share may be paid in three ways: to a blocked<br />

current account, the PEE and the PERCO.<br />

❖ Company savings plans<br />

The monies paid in under the various profit-sharing<br />

agreements or voluntary payments may be invested in<br />

mutual funds. The PEE covers employees in <strong>Virbac</strong>, <strong>Virbac</strong><br />

Distribution, <strong>Virbac</strong> France, Francodex and Alfamed.<br />

The PEE, managed by CREELIA, is comprised of equities,<br />

bonds and treasuries: around 3/4 equities and 1/4 bonds<br />

and treasuries. The portion of <strong>Virbac</strong> shares represents<br />

around 1/3 of the portfolio. The PERCO, collective<br />

retirement savings plan, managed by Novacy, allows<br />

employees to build up a diversified savings portfolio for<br />

their retirement.<br />

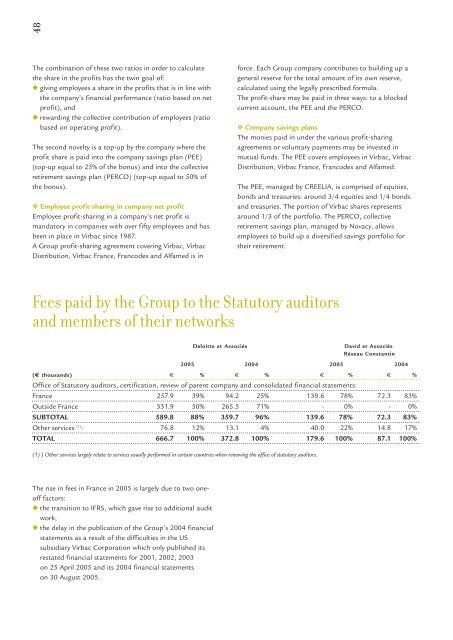

Fees paid by the Group to the Statutory auditors<br />

and members of their networks<br />

Deloitte et Associés<br />

David et Associés<br />

Réseau Constantin<br />

<strong>2005</strong> 2004 <strong>2005</strong> 2004<br />

(€ thousands) € % € % € % € %<br />

Office of Statutory auditors, certification, review of parent company and consolidated financial statements:<br />

France 257.9 39% 94.2 25% 139.6 78% 72.3 83%<br />

Outside France 331.9 50% 265.5 71% - 0% - 0%<br />

SUBTOTAL 589.8 88% 359.7 96% 139.6 78% 72.3 83%<br />

Other services (1) : 76.8 12% 13.1 4% 40.0 22% 14.8 17%<br />

TOTAL 666.7 100% 372.8 100% 179.6 100% 87.1 100%<br />

(1) ) Other services largely relate to services usually performed in certain countries when renewing the office of statutory auditors.<br />

The rise in fees in France in <strong>2005</strong> is largely due to two oneoff<br />

factors:<br />

◆ the transition to IFRS, which gave rise to additional audit<br />

work,<br />

◆ the delay in the publication of the Group’s 2004 financial<br />

statements as a result of the difficulties in the US<br />

subsidiary <strong>Virbac</strong> Corporation which only published its<br />

restated financial statements for 2001, 2002, 2003<br />

on 25 April <strong>2005</strong> and its 2004 financial statements<br />

on 30 August <strong>2005</strong>.