2005 Annual report - Virbac

2005 Annual report - Virbac

2005 Annual report - Virbac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

43<br />

◆ Investors and analysts are welcome to contact the Financial<br />

affairs department for all questions on Group strategy,<br />

products and significant events.<br />

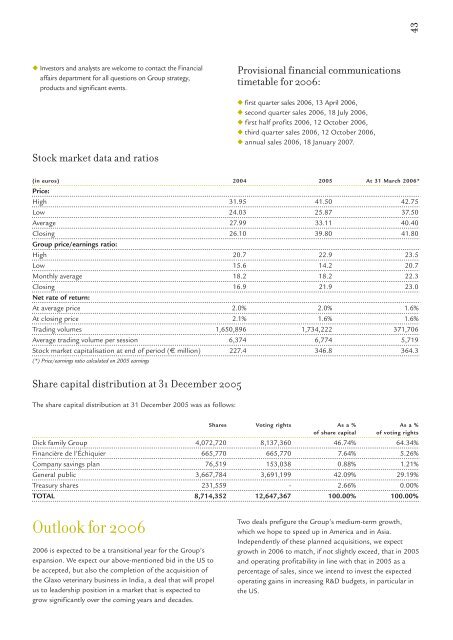

Stock market data and ratios<br />

Provisional financial communications<br />

timetable for 2006:<br />

◆ first quarter sales 2006, 13 April 2006,<br />

◆ second quarter sales 2006, 18 July 2006,<br />

◆ first half profits 2006, 12 October 2006,<br />

◆ third quarter sales 2006, 12 October 2006,<br />

◆ annual sales 2006, 18 January 2007.<br />

(in euros) 2004 <strong>2005</strong> At 31 March 2006*<br />

Price:<br />

High 31.95 41.50 42.75<br />

Low 24.03 25.87 37.50<br />

Average 27.99 33.11 40.40<br />

Closing 26.10 39.80 41.80<br />

Group price/earnings ratio:<br />

High 20.7 22.9 23.5<br />

Low 15.6 14.2 20.7<br />

Monthly average 18.2 18.2 22.3<br />

Closing 16.9 21.9 23.0<br />

Net rate of return:<br />

At average price 2.0% 2.0% 1.6%<br />

At closing price 2.1% 1.6% 1.6%<br />

Trading volumes 1,650,896 1,734,222 371,706<br />

Average trading volume per session 6,374 6,774 5,719<br />

Stock market capitalisation at end of period (€ million) 227.4 346.8 364.3<br />

(*) Price/earnings ratio calculated on <strong>2005</strong> earnings<br />

Share capital distribution at 31 December <strong>2005</strong><br />

The share capital distribution at 31 December <strong>2005</strong> was as follows:<br />

Shares Voting rights As a % As a %<br />

of share capital of voting rights<br />

Dick family Group 4,072,720 8,137,360 46.74% 64.34%<br />

Financière de l’Échiquier 665,770 665,770 7.64% 5.26%<br />

Company savings plan 76,519 153,038 0.88% 1.21%<br />

General public 3,667,784 3,691,199 42.09% 29.19%<br />

Treasury shares 231,559 - 2.66% 0.00%<br />

TOTAL 8,714,352 12,647,367 100.00% 100.00%<br />

Outlook for 2006<br />

2006 is expected to be a transitional year for the Group’s<br />

expansion. We expect our above-mentioned bid in the US to<br />

be accepted, but also the completion of the acquisition of<br />

the Glaxo veterinary business in India, a deal that will propel<br />

us to leadership position in a market that is expected to<br />

grow significantly over the coming years and decades.<br />

Two deals prefigure the Group’s medium-term growth,<br />

which we hope to speed up in America and in Asia.<br />

Independently of these planned acquisitions, we expect<br />

growth in 2006 to match, if not slightly exceed, that in <strong>2005</strong><br />

and operating profitability in line with that in <strong>2005</strong> as a<br />

percentage of sales, since we intend to invest the expected<br />

operating gains in increasing R&D budgets, in particular in<br />

the US.