2005 Annual report - Virbac

2005 Annual report - Virbac

2005 Annual report - Virbac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80<br />

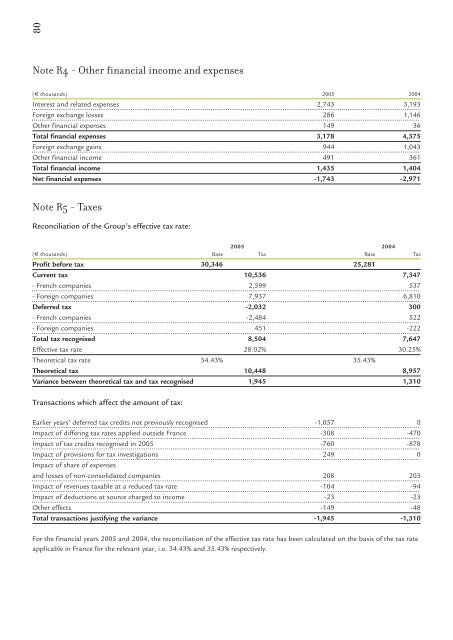

Note R4 - Other financial income and expenses<br />

(€ thousands) <strong>2005</strong> 2004<br />

Interest and related expenses 2,743 3,193<br />

Foreign exchange losses 286 1,146<br />

Other financial expenses 149 36<br />

Total financial expenses 3,178 4,375<br />

Foreign exchange gains 944 1,043<br />

Other financial income 491 361<br />

Total financial income 1,435 1,404<br />

Net financial expenses -1,743 -2,971<br />

Note R5 - Taxes<br />

Reconciliation of the Group’s effective tax rate:<br />

<strong>2005</strong> 2004<br />

(€ thousands) Base Tax Base Tax<br />

Profit before tax 30,346 25,281<br />

Current tax 10,536 7,347<br />

- French companies 2,599 537<br />

- Foreign companies 7,937 6,810<br />

Deferred tax -2,032 300<br />

- French companies -2,484 522<br />

- Foreign companies 451 -222<br />

Total tax recognised 8,504 7,647<br />

Effective tax rate 28.02% 30.25%<br />

Theoretical tax rate 34.43% 35.43%<br />

Theoretical tax 10,448 8,957<br />

Variance between theoretical tax and tax recognised 1,945 1,310<br />

Transactions which affect the amount of tax:<br />

Earlier years’ deferred tax credits not previously recognised -1,057 0<br />

Impact of differing tax rates applied outside France -308 -470<br />

Impact of tax credits recognised in <strong>2005</strong> -760 -878<br />

Impact of provisions for tax investigations 249 0<br />

Impact of share of expenses<br />

and losses of non-consolidated companies 208 203<br />

Impact of revenues taxable at a reduced tax rate -104 -94<br />

Impact of deductions at source charged to income -23 -23<br />

Other effects -149 -48<br />

Total transactions justifying the variance -1,945 -1,310<br />

For the financial years <strong>2005</strong> and 2004, the reconciliation of the effective tax rate has been calculated on the basis of the tax rate<br />

applicable in France for the relevant year, i.e. 34.43% and 35.43% respectively.