2005 Annual report - Virbac

2005 Annual report - Virbac

2005 Annual report - Virbac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

83<br />

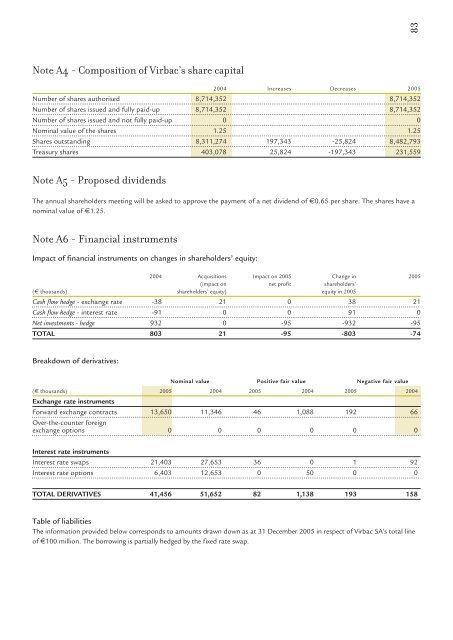

Note A4 - Composition of <strong>Virbac</strong>’s share capital<br />

2004 Increases Decreases <strong>2005</strong><br />

Number of shares authorised 8,714,352 8,714,352<br />

Number of shares issued and fully paid-up 8,714,352 8,714,352<br />

Number of shares issued and not fully paid-up 0 0<br />

Nominal value of the shares 1.25 1.25<br />

Shares outstanding 8,311,274 197,343 -25,824 8,482,793<br />

Treasury shares 403,078 25,824 -197,343 231,559<br />

Note A5 - Proposed dividends<br />

The annual shareholders meeting will be asked to approve the payment of a net dividend of €0.65 per share. The shares have a<br />

nominal value of €1.25.<br />

Note A6 - Financial instruments<br />

Impact of financial instruments on changes in shareholders’ equity:<br />

2004 Acquisitions Impact on <strong>2005</strong> Change in <strong>2005</strong><br />

(impact on net profit shareholders’<br />

(€ thousands) shareholders’ equity) equity in <strong>2005</strong><br />

Cash flow hedge - exchange rate -38 21 0 38 21<br />

Cash flow hedge - interest rate -91 0 0 91 0<br />

Net investments - hedge 932 0 -95 -932 -95<br />

TOTAL 803 21 -95 -803 -74<br />

Breakdown of derivatives:<br />

Nominal value Positive fair value Negative fair value<br />

(€ thousands) <strong>2005</strong> 2004 <strong>2005</strong> 2004 <strong>2005</strong> 2004<br />

Exchange rate instruments<br />

Forward exchange contracts 13,650 11,346 46 1,088 192 66<br />

Over-the-counter foreign<br />

exchange options 0 0 0 0 0 0<br />

Interest rate instruments<br />

Interest rate swaps 21,403 27,653 36 0 1 92<br />

Interest rate options 6,403 12,653 0 50 0 0<br />

TOTAL DERIVATIVES 41,456 51,652 82 1,138 193 158<br />

Table of liabilities<br />

The information provided below corresponds to amounts drawn down as at 31 December <strong>2005</strong> in respect of <strong>Virbac</strong> SA’s total line<br />

of €100 million. The borrowing is partially hedged by the fixed rate swap.