2005 Annual report - Virbac

2005 Annual report - Virbac

2005 Annual report - Virbac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

88<br />

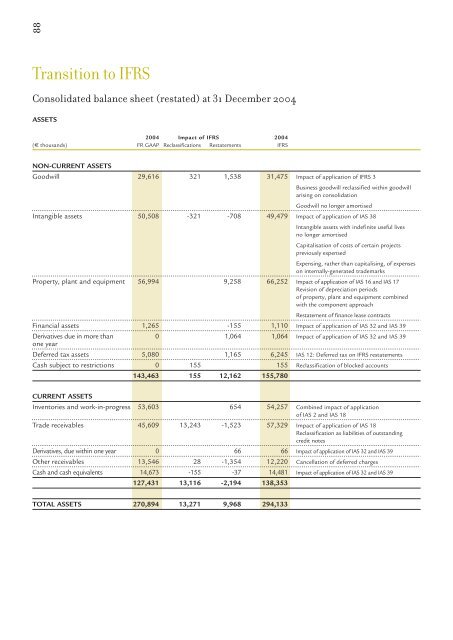

Transition to IFRS<br />

Consolidated balance sheet (restated) at 31 December 2004<br />

ASSETS<br />

2004 Impact of IFRS 2004<br />

(€ thousands) FR GAAP Reclassifications Restatements IFRS<br />

NON-CURRENT ASSETS<br />

Goodwill 29,616 321 1,538 31,475 Impact of application of IFRS 3<br />

Business goodwill reclassified within goodwill<br />

arising on consolidation<br />

Goodwill no longer amortised<br />

Intangible assets 50,508 -321 -708 49,479 Impact of application of IAS 38<br />

Intangible assets with indefinite useful lives<br />

no longer amortised<br />

Capitalisation of costs of certain projects<br />

previously expensed<br />

Expensing, rather than capitalising, of expenses<br />

on internally-generated trademarks<br />

Property, plant and equipment 56,994 9,258 66,252 Impact of application of IAS 16 and IAS 17<br />

Revision of depreciation periods<br />

of property, plant and equipment combined<br />

with the component approach<br />

Restatement of finance lease contracts<br />

Financial assets 1,265 -155 1,110 Impact of application of IAS 32 and IAS 39<br />

Derivatives due in more than 0 1,064 1,064 Impact of application of IAS 32 and IAS 39<br />

one year<br />

Deferred tax assets 5,080 1,165 6,245 IAS 12: Deferred tax on IFRS restatements<br />

Cash subject to restrictions 0 155 155 Reclassification of blocked accounts<br />

143,463 155 12,162 155,780<br />

CURRENT ASSETS<br />

Inventories and work-in-progress 53,603 654 54,257 Combined impact of application<br />

of IAS 2 and IAS 18<br />

Trade receivables 45,609 13,243 -1,523 57,329 Impact of application of IAS 18<br />

Reclassification as liabilities of outstanding<br />

credit notes<br />

Derivatives, due within one year 0 66 66 Impact of application of IAS 32 and IAS 39<br />

Other receivables 13,546 28 -1,354 12,220 Cancellation of deferred charges<br />

Cash and cash equivalents 14,673 -155 -37 14,481 Impact of application of IAS 32 and IAS 39<br />

127,431 13,116 -2,194 138,353<br />

TOTAL ASSETS 270,894 13,271 9,968 294,133