Highways Agency Annual Report and Accounts 2011-2012

Highways Agency Annual Report and Accounts 2011-2012

Highways Agency Annual Report and Accounts 2011-2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

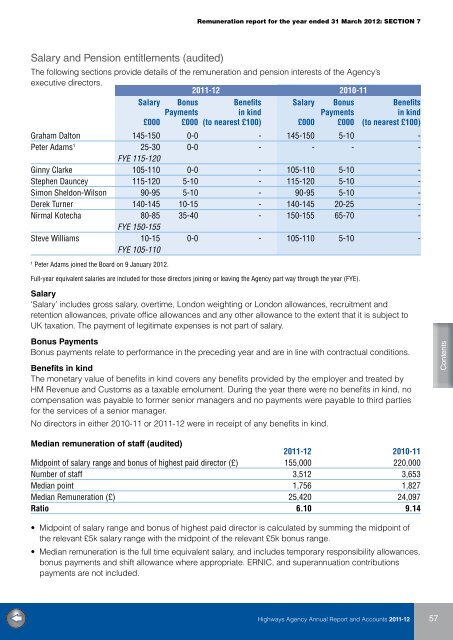

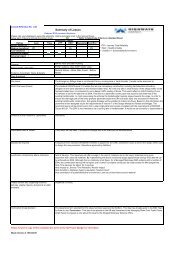

Remuneration report for the year ended 31 March <strong>2012</strong>: SECTION 7<br />

Salary <strong>and</strong> Pension entitlements (audited)<br />

The following sections provide details of the remuneration <strong>and</strong> pension interests of the <strong>Agency</strong>’s<br />

executive directors.<br />

<strong>2011</strong>-12 2010-11<br />

Salary Bonus Benefits Salary Bonus Benefits<br />

Payments in kind Payments in kind<br />

£000 £000 (to nearest £100) £000 £000 (to nearest £100)<br />

Graham Dalton 145-150 0-0 - 145-150 5-10 -<br />

Peter Adams 1 25-30 0-0 - - - -<br />

FYE 115-120<br />

Ginny Clarke 105-110 0-0 - 105-110 5-10 -<br />

Stephen Dauncey 115-120 5-10 - 115-120 5-10 -<br />

Simon Sheldon-Wilson 90-95 5-10 - 90-95 5-10 -<br />

Derek Turner 140-145 10-15 - 140-145 20-25 -<br />

Nirmal Kotecha 80-85 35-40 - 150-155 65-70 -<br />

FYE 150-155<br />

Steve Williams 10-15 0-0 - 105-110 5-10 -<br />

FYE 105-110<br />

1<br />

Peter Adams joined the Board on 9 January <strong>2012</strong>.<br />

Full-year equivalent salaries are included for those directors joining or leaving the <strong>Agency</strong> part way through the year (FYE).<br />

Salary<br />

‘Salary’ includes gross salary, overtime, London weighting or London allowances, recruitment <strong>and</strong><br />

retention allowances, private office allowances <strong>and</strong> any other allowance to the extent that it is subject to<br />

UK taxation. The payment of legitimate expenses is not part of salary.<br />

Bonus Payments<br />

Bonus payments relate to performance in the preceding year <strong>and</strong> are in line with contractual conditions.<br />

Benefits in kind<br />

The monetary value of benefits in kind covers any benefits provided by the employer <strong>and</strong> treated by<br />

HM Revenue <strong>and</strong> Customs as a taxable emolument. During the year there were no benefits in kind, no<br />

compensation was payable to former senior managers <strong>and</strong> no payments were payable to third parties<br />

for the services of a senior manager.<br />

No directors in either 2010-11 or <strong>2011</strong>-12 were in receipt of any benefits in kind.<br />

Median remuneration of staff (audited)<br />

<strong>2011</strong>-12 2010-11<br />

Midpoint of salary range <strong>and</strong> bonus of highest paid director (£) 155,000 220,000<br />

Number of staff 3,512 3,653<br />

Median point 1,756 1,827<br />

Median Remuneration (£) 25,420 24,097<br />

Ratio 6.10 9.14<br />

• Midpoint of salary range <strong>and</strong> bonus of highest paid director is calculated by summing the midpoint of<br />

the relevant £5k salary range with the midpoint of the relevant £5k bonus range.<br />

• Median remuneration is the full time equivalent salary, <strong>and</strong> includes temporary responsibility allowances,<br />

bonus payments <strong>and</strong> shift allowance where appropriate. ERNIC, <strong>and</strong> superannuation contributions<br />

payments are not included.<br />

<strong>Highways</strong> <strong>Agency</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong>-12