Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

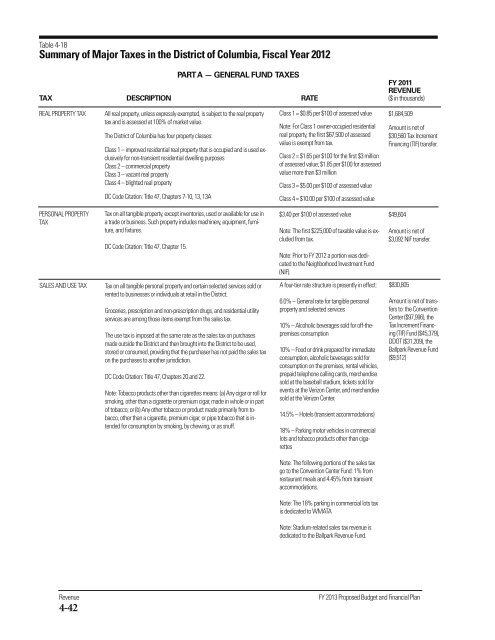

Table 4-18<br />

<strong>Summary</strong> <strong>of</strong> Major Taxes in <strong>the</strong> District <strong>of</strong> Columbia, Fiscal Year 2012<br />

PART A — GENERAL FUND TAXES<br />

FY 2011<br />

REVENUE<br />

TAX DESCRIPTION RATE ($ in thousands)<br />

REAL PROPERTY TAX<br />

All real property, unless expressly exempted, is subject to <strong>the</strong> real property<br />

tax and is assessed at 100% <strong>of</strong> market value.<br />

The District <strong>of</strong> Columbia has four property classes:<br />

Class 1 – improved residential real property that is occupied and is used exclusively<br />

for non-transient residential dwelling purposes<br />

Class 2 – commercial property<br />

Class 3 – vacant real property<br />

Class 4 – blighted real property<br />

DC Code Citation: Title 47, Chapters 7-10, 13, 13A<br />

Class 1 = $0.85 per $100 <strong>of</strong> assessed value<br />

Note: For Class 1 owner-occupied residential<br />

real property, <strong>the</strong> first $67,500 <strong>of</strong> assessed<br />

value is exempt from tax.<br />

Class 2 = $1.65 per $100 for <strong>the</strong> first $3 million<br />

<strong>of</strong> assessed value; $1.85 per $100 for assessed<br />

value more than $3 million<br />

Class 3 = $5.00 per $100 <strong>of</strong> assessed value<br />

Class 4 = $10.00 per $100 <strong>of</strong> assessed value<br />

$1,684,509<br />

Amount is net <strong>of</strong><br />

$30,560 Tax Increment<br />

Financing (TIF) transfer.<br />

PERSONAL PROPERTY<br />

TAX<br />

Tax on all tangible property, except inventories, used or available for use in<br />

a trade or business. Such property includes machinery, equipment, furniture,<br />

and fixtures.<br />

DC Code Citation: Title 47, Chapter 15.<br />

$3.40 per $100 <strong>of</strong> assessed value<br />

Note: The first $225,000 <strong>of</strong> taxable value is excluded<br />

from tax.<br />

Note: Prior to FY 2012 a portion was dedicated<br />

to <strong>the</strong> Neighborhood Investment Fund<br />

(NIF).<br />

$49,604<br />

Amount is net <strong>of</strong><br />

$3,092 NIF transfer.<br />

SALES AND USE TAX<br />

Tax on all tangible personal property and certain selected services sold or<br />

rented to businesses or individuals at retail in <strong>the</strong> District.<br />

Groceries, prescription and non-prescription drugs, and residential utility<br />

services are among those items exempt from <strong>the</strong> sales tax.<br />

The use tax is imposed at <strong>the</strong> same rate as <strong>the</strong> sales tax on purchases<br />

made outside <strong>the</strong> District and <strong>the</strong>n brought into <strong>the</strong> District to be used,<br />

stored or consumed, providing that <strong>the</strong> purchaser has not paid <strong>the</strong> sales tax<br />

on <strong>the</strong> purchases to ano<strong>the</strong>r jurisdiction.<br />

DC Code Citation: Title 47, Chapters 20 and 22.<br />

Note: Tobacco products o<strong>the</strong>r than cigarettes means: (a) Any cigar or roll for<br />

smoking, o<strong>the</strong>r than a cigarette or premium cigar, made in whole or in part<br />

<strong>of</strong> tobacco; or (b) Any o<strong>the</strong>r tobacco or product made primarily from tobacco,<br />

o<strong>the</strong>r than a cigarette, premium cigar, or pipe tobacco that is intended<br />

for consumption by smoking, by chewing, or as snuff.<br />

A four-tier rate structure is presently in effect:<br />

6.0% – General rate for tangible personal<br />

property and selected services<br />

10% – Alcoholic beverages sold for <strong>of</strong>f-<strong>the</strong>premises<br />

consumption<br />

10% – Food or drink prepared for immediate<br />

consumption, alcoholic beverages sold for<br />

consumption on <strong>the</strong> premises, rental vehicles,<br />

prepaid telephone calling cards, merchandise<br />

sold at <strong>the</strong> baseball stadium, tickets sold for<br />

events at <strong>the</strong> Verizon Center, and merchandise<br />

sold at <strong>the</strong> Verizon Center.<br />

14.5% – Hotels (transient accommodations)<br />

18% – Parking motor vehicles in commercial<br />

lots and tobacco products o<strong>the</strong>r than cigarettes<br />

$830,805<br />

Amount is net <strong>of</strong> transfers<br />

to: <strong>the</strong> Convention<br />

Center ($97,996), <strong>the</strong><br />

Tax Increment Financing<br />

(TIF) Fund ($45,379),<br />

DDOT ($31,209), <strong>the</strong><br />

Ballpark Revenue Fund<br />

($9,512)<br />

Note: The following portions <strong>of</strong> <strong>the</strong> sales tax<br />

go to <strong>the</strong> Convention Center Fund: 1% from<br />

restaurant meals and 4.45% from transient<br />

accommodations.<br />

Note: The 18% parking in commercial lots tax<br />

is dedicated to WMATA<br />

Note: Stadium-related sales tax revenue is<br />

dedicated to <strong>the</strong> Ballpark Revenue Fund.<br />

Revenue<br />

4-42<br />

FY 2013 Proposed Budget and <strong>Financial</strong> Plan