Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

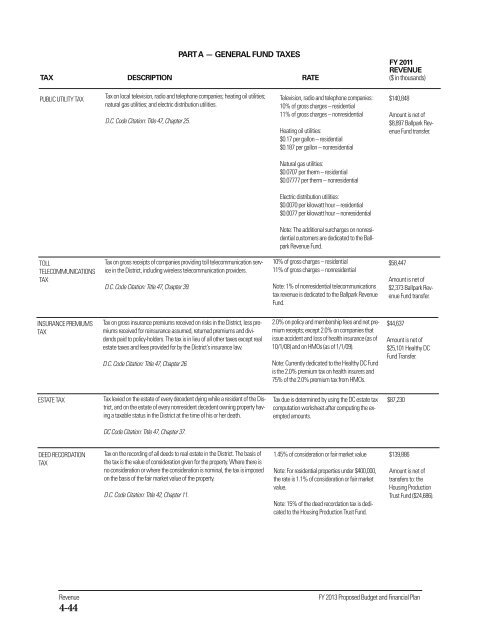

PART A — GENERAL FUND TAXES<br />

FY 2011<br />

REVENUE<br />

TAX DESCRIPTION RATE ($ in thousands)<br />

PUBLIC UTILITY TAX<br />

Tax on local television, radio and telephone companies; heating oil utilities;<br />

natural gas utilities; and electric distribution utilities.<br />

D.C. Code Citation: Title 47, Chapter 25.<br />

Television, radio and telephone companies:<br />

10% <strong>of</strong> gross charges – residential<br />

11% <strong>of</strong> gross charges – nonresidential<br />

Heating oil utilities:<br />

$0.17 per gallon – residential<br />

$0.187 per gallon – nonresidential<br />

$140,848<br />

Amount is net <strong>of</strong><br />

$8,897 Ballpark Revenue<br />

Fund transfer.<br />

Natural gas utilities:<br />

$0.0707 per <strong>the</strong>rm – residential<br />

$0.07777 per <strong>the</strong>rm – nonresidential<br />

Electric distribution utilities:<br />

$0.0070 per kilowatt hour – residential<br />

$0.0077 per kilowatt hour – nonresidential<br />

Note: The additional surcharges on nonresidential<br />

customers are dedicated to <strong>the</strong> Ballpark<br />

Revenue Fund.<br />

TOLL<br />

TELECOMMUNICATIONS<br />

TAX<br />

Tax on gross receipts <strong>of</strong> companies providing toll telecommunication service<br />

in <strong>the</strong> District, including wireless telecommunication providers.<br />

D.C. Code Citation: Title 47, Chapter 39.<br />

10% <strong>of</strong> gross charges – residential<br />

11% <strong>of</strong> gross charges – nonresidential<br />

Note: 1% <strong>of</strong> nonresidential telecommunications<br />

tax revenue is dedicated to <strong>the</strong> Ballpark Revenue<br />

Fund.<br />

$58,447<br />

Amount is net <strong>of</strong><br />

$2,373 Ballpark Revenue<br />

Fund transfer.<br />

INSURANCE PREMIUMS<br />

TAX<br />

Tax on gross insurance premiums received on risks in <strong>the</strong> District, less premiums<br />

received for reinsurance assumed, returned premiums and dividends<br />

paid to policy-holders. The tax is in lieu <strong>of</strong> all o<strong>the</strong>r taxes except real<br />

estate taxes and fees provided for by <strong>the</strong> District's insurance law.<br />

D.C. Code Citation: Title 47, Chapter 26.<br />

2.0% on policy and membership fees and net premium<br />

receipts; except 2.0% on companies that<br />

issue accident and loss <strong>of</strong> health insurance (as <strong>of</strong><br />

10/1/08) and on HMOs (as <strong>of</strong> 1/1/09).<br />

Note: Currently dedicated to <strong>the</strong> Healthy DC Fund<br />

is <strong>the</strong> 2.0% premium tax on health insurers and<br />

75% <strong>of</strong> <strong>the</strong> 2.0% premium tax from HMOs.<br />

$44,637<br />

Amount is net <strong>of</strong><br />

$25,101 Healthy DC<br />

Fund Transfer.<br />

ESTATE TAX<br />

Tax levied on <strong>the</strong> estate <strong>of</strong> every decedent dying while a resident <strong>of</strong> <strong>the</strong> District,<br />

and on <strong>the</strong> estate <strong>of</strong> every nonresident decedent owning property having<br />

a taxable status in <strong>the</strong> District at <strong>the</strong> time <strong>of</strong> his or her death.<br />

Tax due is determined by using <strong>the</strong> DC estate tax<br />

computation worksheet after computing <strong>the</strong> exempted<br />

amounts.<br />

$87,230<br />

DC Code Citation: Title 47, Chapter 37.<br />

DEED RECORDATION<br />

TAX<br />

Tax on <strong>the</strong> recording <strong>of</strong> all deeds to real estate in <strong>the</strong> District. The basis <strong>of</strong><br />

<strong>the</strong> tax is <strong>the</strong> value <strong>of</strong> consideration given for <strong>the</strong> property. Where <strong>the</strong>re is<br />

no consideration or where <strong>the</strong> consideration is nominal, <strong>the</strong> tax is imposed<br />

on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> fair market value <strong>of</strong> <strong>the</strong> property.<br />

D.C. Code Citation: Title 42, Chapter 11.<br />

1.45% <strong>of</strong> consideration or fair market value<br />

Note: For residential properties under $400,000,<br />

<strong>the</strong> rate is 1.1% <strong>of</strong> consideration or fair market<br />

value.<br />

Note: 15% <strong>of</strong> <strong>the</strong> deed recordation tax is dedicated<br />

to <strong>the</strong> Housing Production Trust Fund.<br />

$139,886<br />

Amount is net <strong>of</strong><br />

transfers to: <strong>the</strong><br />

Housing Production<br />

Trust Fund ($24,686).<br />

Revenue<br />

4-44<br />

FY 2013 Proposed Budget and <strong>Financial</strong> Plan