Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Revenue FY 2013 Proposed Budget and <strong>Financial</strong> Plan<br />

4-32<br />

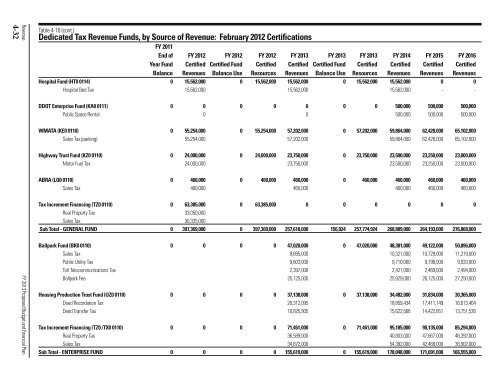

Table 4-16 (cont.)<br />

Dedicated Tax Revenue Funds, by Source <strong>of</strong> Revenue: February 2012 Certifications<br />

FY 2011<br />

End <strong>of</strong> FY 2012 FY 2012 FY 2012 FY 2013 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016<br />

Year Fund Certified Certified Fund Certified Certified Certified Fund Certified Certified Certified Certified<br />

Balance Revenues Balance Use Resources Revenues Balance Use Resources Revenues Revenues Revenues<br />

Hospital Fund (HT0 0114) 0 15,562,000 0 15,562,000 15,562,000 0 15,562,000 15,562,000 0 0<br />

Hospital Bed Tax 15,562,000 15,562,000 15,562,000 - -<br />

DDOT Enterprise Fund (KA0 0111) 0 0 0 0 0 0 0 500,000 500,000 500,000<br />

Public Space Rental 0 0 500,000 500,000 500,000<br />

WMATA (KE0 0110) 0 55,254,000 0 55,254,000 57,202,000 0 57,202,000 59,864,000 62,428,000 65,102,000<br />

Sales Tax (parking) 55,254,000 57,202,000 59,864,000 62,428,000 65,102,000<br />

Highway Trust Fund (KZ0 0110) 0 24,000,000 0 24,000,000 23,750,000 0 23,750,000 23,500,000 23,250,000 23,000,000<br />

Motor Fuel Tax 24,000,000 23,750,000 23,500,000 23,250,000 23,000,000<br />

ABRA (LQ0 0110) 0 460,000 0 460,000 460,000 0 460,000 460,000 460,000 460,000<br />

Sales Tax 460,000 460,000 460,000 460,000 460,000<br />

Tax Increment Financing (TZ0 0110) 0 63,385,000 0 63,385,000 0 0 0 0 0 0<br />

Real Property Tax 33,050,000<br />

Sales Tax 30,335,000<br />

Sub Total - GENERAL FUND 0 397,369,000 0 397,369,000 257,618,000 156,924 257,774,924 268,889,000 264,193,000 276,868,000<br />

Ballpark Fund (BK0 0110) 0 0 0 0 47,020,000 0 47,020,000 48,381,000 49,122,000 50,896,000<br />

Sales Tax 9,895,000 10,321,000 10,729,000 11,219,000<br />

Public Utility Tax 9,603,000 9,710,000 9,799,000 9,933,000<br />

Toll Telecommunications Tax 2,397,000 2,421,000 2,469,000 2,494,000<br />

Ballpark Fee 25,125,000 25,929,000 26,125,000 27,250,000<br />

Housing Production Trust Fund (UZ0 0110) 0 0 0 0 37,138,000 0 37,138,000 34,482,000 31,834,000 30,365,000<br />

Deed Recordation Tax 20,312,095 18,859,434 17,411,149 16,613,464<br />

Deed Transfer Tax 16,825,905 15,622,566 14,422,851 13,751,536<br />

Tax Increment Financing (TZ0 /TX0 0110) 0 0 0 0 71,461,000 0 71,461,000 95,185,000 90,135,000 85,294,000<br />

Real Property Tax 36,589,000 40,803,000 47,667,000 46,392,000<br />

Sales Tax 34,872,000 54,382,000 42,468,000 38,902,000<br />

Sub Total - ENTERPRISE FUND 0 0 0 0 155,619,000 0 155,619,000 178,048,000 171,091,000 166,555,000