Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FY 2013 Proposed Budget and <strong>Financial</strong> Plan Revenue<br />

4-59<br />

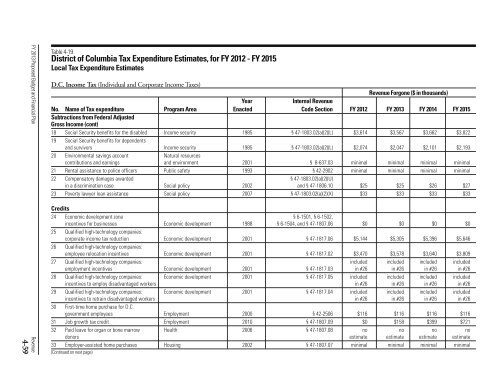

Table 4-19<br />

District <strong>of</strong> Columbia Tax Expenditure Estimates, for FY 2012 - FY 2015<br />

Local Tax Expenditure Estimates<br />

D.C. Income Tax (Individual and Corporate Income Taxes)<br />

Revenue Forgone ($ in thousands)<br />

Year<br />

Internal Revenue<br />

No. Name <strong>of</strong> Tax expenditure Program Area Enacted Code Section FY 2012 FY 2013 FY 2014 FY 2015<br />

Subtractions from Federal Adjusted<br />

Gross Income (cont)<br />

18 Social Security benefits for <strong>the</strong> disabled Income security 1985 § 47-1803.02(a)(2)(L) $3,614 $3,567 $3,662 $3,822<br />

19 Social Security benefits for dependents<br />

and survivors Income security 1985 § 47-1803.02(a)(2)(L) $2,074 $2,047 $2,101 $2,193<br />

20 Environmental savings account Natural resources<br />

contributions and earnings and environment 2001 § 8-637.03 minimal minimal minimal minimal<br />

21 Rental assistance to police <strong>of</strong>ficers Public safety 1993 § 42-2902 minimal minimal minimal minimal<br />

22 Compensatory damages awarded § 47-1803.02(a)(2)(U)<br />

in a discrimination case Social policy 2002 and § 47-1806.10 $25 $25 $26 $27<br />

23 Poverty lawyer loan assistance Social policy 2007 § 47-1803.02(a)(2)(X) $33 $33 $33 $33<br />

Credits<br />

24 Economic development zone § 6-1501, § 6-1502,<br />

incentives for businesses Economic development 1988 § 6-1504, and § 47-1807.06 $0 $0 $0 $0<br />

25 Qualified high-technology companies:<br />

corporate income tax reduction Economic development 2001 § 47-1817.06 $5,144 $5,305 $5,396 $5,646<br />

26 Qualified high-technology companies:<br />

employee relocation incentives Economic development 2001 § 47-1817.02 $3,470 $3,578 $3,640 $3,809<br />

27 Qualified high-technology companies: included included included included<br />

employment incentives Economic development 2001 § 47-1817.03 in #26 in #26 in #26 in #26<br />

28 Qualified high-technology companies: Economic development 2001 § 47-1817.05 included included included included<br />

incentives to employ disadvantaged workers in #26 in #26 in #26 in #26<br />

29 Qualified high-technology companies: Economic development 2001 § 47-1817.04 included included included included<br />

incentives to retrain disadvantaged workers in #26 in #26 in #26 in #26<br />

30 First-time home purchase for D.C.<br />

government employees Employment 2000 § 42-2506 $116 $116 $116 $116<br />

31 Job growth tax credit Employment 2010 § 47-1807.09 $0 $158 $399 $721<br />

32 Paid leave for organ or bone marrow Health 2006 § 47-1807.08 no no no no<br />

donors estimate estimate estimate estimate<br />

33 Employer-assisted home purchases Housing 2002 § 47-1807.07 minimal minimal minimal minimal<br />

(Continued on next page)