Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

Volume 1 - Executive Summary - Office of the Chief Financial Officer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

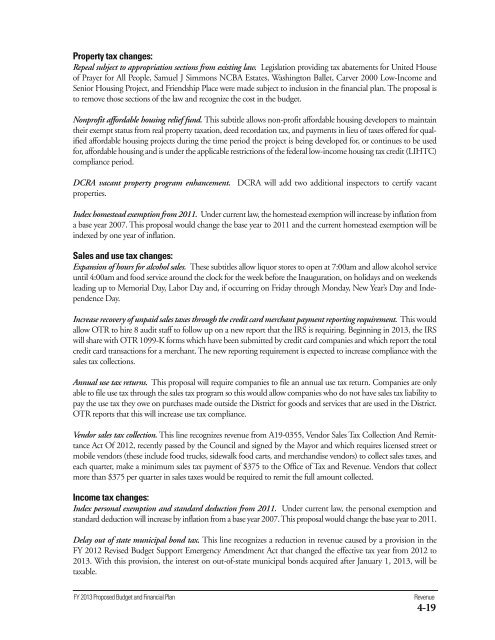

Property tax changes:<br />

Repeal subject to appropriation sections from existing law. Legislation providing tax abatements for United House<br />

<strong>of</strong> Prayer for All People, Samuel J Simmons NCBA Estates, Washington Ballet, Carver 2000 Low-Income and<br />

Senior Housing Project, and Friendship Place were made subject to inclusion in <strong>the</strong> financial plan. The proposal is<br />

to remove those sections <strong>of</strong> <strong>the</strong> law and recognize <strong>the</strong> cost in <strong>the</strong> budget.<br />

Nonpr<strong>of</strong>it affordable housing relief fund. This subtitle allows non-pr<strong>of</strong>it affordable housing developers to maintain<br />

<strong>the</strong>ir exempt status from real property taxation, deed recordation tax, and payments in lieu <strong>of</strong> taxes <strong>of</strong>fered for qualified<br />

affordable housing projects during <strong>the</strong> time period <strong>the</strong> project is being developed for, or continues to be used<br />

for, affordable housing and is under <strong>the</strong> applicable restrictions <strong>of</strong> <strong>the</strong> federal low-income housing tax credit (LIHTC)<br />

compliance period.<br />

DCRA vacant property program enhancement. DCRA will add two additional inspectors to certify vacant<br />

properties.<br />

Index homestead exemption from 2011. Under current law, <strong>the</strong> homestead exemption will increase by inflation from<br />

a base year 2007. This proposal would change <strong>the</strong> base year to 2011 and <strong>the</strong> current homestead exemption will be<br />

indexed by one year <strong>of</strong> inflation.<br />

Sales and use tax changes:<br />

Expansion <strong>of</strong> hours for alcohol sales. These subtitles allow liquor stores to open at 7:00am and allow alcohol service<br />

until 4:00am and food service around <strong>the</strong> clock for <strong>the</strong> week before <strong>the</strong> Inauguration, on holidays and on weekends<br />

leading up to Memorial Day, Labor Day and, if occurring on Friday through Monday, New Year’s Day and Independence<br />

Day.<br />

Increase recovery <strong>of</strong> unpaid sales taxes through <strong>the</strong> credit card merchant payment reporting requirement. This would<br />

allow OTR to hire 8 audit staff to follow up on a new report that <strong>the</strong> IRS is requiring. Beginning in 2013, <strong>the</strong> IRS<br />

will share with OTR 1099-K forms which have been submitted by credit card companies and which report <strong>the</strong> total<br />

credit card transactions for a merchant. The new reporting requirement is expected to increase compliance with <strong>the</strong><br />

sales tax collections.<br />

Annual use tax returns. This proposal will require companies to file an annual use tax return. Companies are only<br />

able to file use tax through <strong>the</strong> sales tax program so this would allow companies who do not have sales tax liability to<br />

pay <strong>the</strong> use tax <strong>the</strong>y owe on purchases made outside <strong>the</strong> District for goods and services that are used in <strong>the</strong> District.<br />

OTR reports that this will increase use tax compliance.<br />

Vendor sales tax collection. This line recognizes revenue from A19-0355, Vendor Sales Tax Collection And Remittance<br />

Act Of 2012, recently passed by <strong>the</strong> Council and signed by <strong>the</strong> Mayor and which requires licensed street or<br />

mobile vendors (<strong>the</strong>se include food trucks, sidewalk food carts, and merchandise vendors) to collect sales taxes, and<br />

each quarter, make a minimum sales tax payment <strong>of</strong> $375 to <strong>the</strong> <strong>Office</strong> <strong>of</strong> Tax and Revenue. Vendors that collect<br />

more than $375 per quarter in sales taxes would be required to remit <strong>the</strong> full amount collected.<br />

Income tax changes:<br />

Index personal exemption and standard deduction from 2011. Under current law, <strong>the</strong> personal exemption and<br />

standard deduction will increase by inflation from a base year 2007. This proposal would change <strong>the</strong> base year to 2011.<br />

Delay out <strong>of</strong> state municipal bond tax. This line recognizes a reduction in revenue caused by a provision in <strong>the</strong><br />

FY 2012 Revised Budget Support Emergency Amendment Act that changed <strong>the</strong> effective tax year from 2012 to<br />

2013. With this provision, <strong>the</strong> interest on out-<strong>of</strong>-state municipal bonds acquired after January 1, 2013, will be<br />

taxable.<br />

FY 2013 Proposed Budget and <strong>Financial</strong> Plan<br />

Revenue<br />

4-19