2007 - April

2007 - April

2007 - April

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.0<br />

Information on the company’s activities<br />

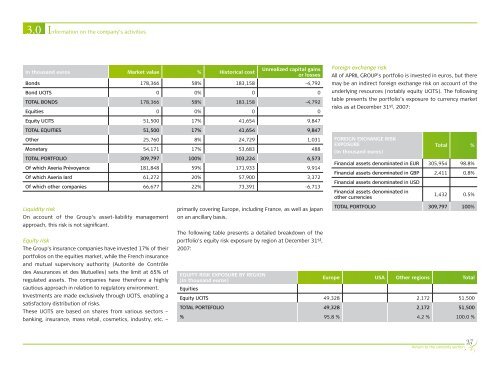

In thousand euros Market value % Historical cost<br />

Unrealized capital gains<br />

or losses<br />

Bonds 178,366 58% 183,158 -4,792<br />

Bond UCITS 0 0% 0 0<br />

TOTAL BONDS 178,366 58% 183,158 -4,792<br />

Equities 0 0% 0 0<br />

Foreign exchange risk<br />

All of APRIL GROUP’s portfolio is invested in euros, but there<br />

may be an indirect foreign exchange risk on account of the<br />

underlying resources (notably equity UCITS). The following<br />

table presents the portfolio’s exposure to currency market<br />

risks as at December 31 st , <strong>2007</strong>:<br />

Equity UCITS 51,500 17% 41,654 9,847<br />

TOTAL EQUITIES 51,500 17% 41,654 9,847<br />

Other 25,760 8% 24,729 1,031<br />

Monetary 54,171 17% 53,683 488<br />

TOTAL PORTFOLIO 309,797 100% 303,224 6,573<br />

Of which Axeria Prévoyance 181,848 59% 171,933 9,914<br />

Of which Axeria Iard 61,272 20% 57,900 3,372<br />

Of which other companies 66,677 22% 73,391 -6,713<br />

FOREIGN EXCHANGE RISK<br />

EXPOSURE<br />

(In thousand euros)<br />

Total %<br />

Financial assets denominated in EUR 305,954 98.8%<br />

Financial assets denominated in GBP 2,411 0.8%<br />

Financial assets denominated in USD<br />

Financial assets denominated in<br />

other currencies<br />

1,432 0.5%<br />

Liquidity risk<br />

On account of the Group’s asset-liability management<br />

approach, this risk is not significant.<br />

Equity risk<br />

The Group’s insurance companies have invested 17% of their<br />

portfolios on the equities market, while the French insurance<br />

and mutual supervisory authority (Autorité de Contrôle<br />

des Assurances et des Mutuelles) sets the limit at 65% of<br />

regulated assets. The companies have therefore a highly<br />

cautious approach in relation to regulatory environment.<br />

Investments are made exclusively through UCITS, enabling a<br />

satisfactory distribution of risks.<br />

These UCITS are based on shares from various sectors –<br />

banking, insurance, mass retail, cosmetics, industry, etc. –<br />

primarily covering Europe, including France, as well as Japan<br />

on an ancillary basis.<br />

The following table presents a detailed breakdown of the<br />

portfolio’s equity risk exposure by region at December 31 st ,<br />

<strong>2007</strong>:<br />

EQUITY RISK EXPOSURE BY REGION<br />

(In thousand euros)<br />

TOTAL PORTFOLIO 309,797 100%<br />

Europe USA Other regions Total<br />

Equities<br />

Equity UCITS 49,328 2,172 51,500<br />

TOTAL PORTEFOLIO 49,328 2,172 51,500<br />

% 95.8 % 4.2 % 100.0 %<br />

27<br />

Return to the contents section