2007 - April

2007 - April

2007 - April

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.0<br />

Information on the company’s activities<br />

The Risk Manager carries out regularly an analysis of the main<br />

insurance policies taken out by Group companies in order to<br />

ensure that the cover in place was sufficient and adapted to<br />

their activities.<br />

All of the abovementioned policies have been taken out with<br />

companies outside of the Group, except for the personal<br />

protection program, which has been taken out with Axeria<br />

Prevoyance, which is part of the Group.<br />

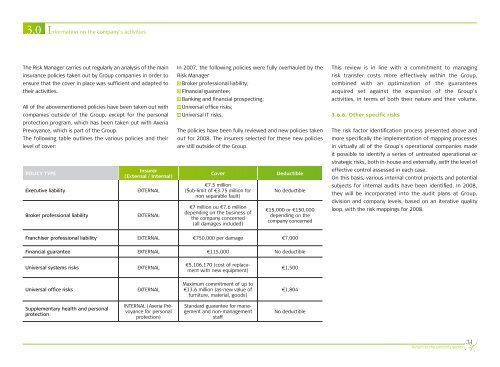

The following table outlines the various policies and their<br />

level of cover:<br />

POLICY TYPE<br />

Executive liability<br />

Broker professional liability<br />

Insurer<br />

(External / Internal)<br />

EXTERNAL<br />

EXTERNAL<br />

In <strong>2007</strong>, the following policies were fully overhauled by the<br />

Risk Manager<br />

Broker professional liability;<br />

Financial guarantee;<br />

Banking and financial prospecting;<br />

Universal office risks;<br />

Universal IT risks.<br />

The policies have been fully reviewed and new policies taken<br />

out for 2008. The insurers selected for these new policies<br />

are still outside of the Group.<br />

Cover<br />

€7.5 million<br />

(Sub-limit of €3.75 million for<br />

non separable fault)<br />

€7 million ou €7.6 million<br />

depending on the business of<br />

the company concerned<br />

(all damages included)<br />

Deductible<br />

No deductible<br />

€15,000 or €150,000<br />

depending on the<br />

company concerned<br />

This review is in line with a commitment to managing<br />

risk transfer costs more effectively within the Group,<br />

combined with an optimization of the guarantees<br />

acquired set against the expansion of the Group’s<br />

activities, in terms of both their nature and their volume.<br />

3.6.6. Other specific risks<br />

The risk factor identification process presented above and<br />

more specifically the implementation of mapping processes<br />

in virtually all of the Group’s operational companies made<br />

it possible to identify a series of untreated operational or<br />

strategic risks, both in-house and externally, with the level of<br />

effective control assessed in each case.<br />

On this basis, various internal control projects and potential<br />

subjects for internal audits have been identified. In 2008,<br />

they will be incorporated into the audit plans at Group,<br />

division and company levels, based on an iterative quality<br />

loop, with the risk mappings for 2008.<br />

Franchiser professional liability EXTERNAL €750,000 per damage €7,000<br />

Financial guarantee EXTERNAL €115,000 No deductible<br />

Universal systems risks<br />

EXTERNAL<br />

€5,106,170 (cost of replacement<br />

with new equipment)<br />

€1,500<br />

Universal office risks<br />

EXTERNAL<br />

Maximum commitment of up to<br />

€13.6 million (as-new value of<br />

furniture, material, goods)<br />

€1,804<br />

Supplementary health and personal<br />

protection<br />

INTERNAL (Axeria Prévoyance<br />

for personal<br />

protection)<br />

Standard guarantee for management<br />

and non-management<br />

staff<br />

No deductible<br />

31<br />

Return to the contents section