Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER 7: Other Federations<br />

Three main tax bases determine the level <strong>of</strong> vertical fiscal imbalance between Federal<br />

and <strong>State</strong> Governments:<br />

• income<br />

• sales <strong>of</strong> goods and services<br />

• natural resources.<br />

Income taxes<br />

In Australia, the <strong>State</strong>s have constitutional access to the income tax base (including<br />

taxes applied on personal and corporate income). However the <strong>Commonwealth</strong> has<br />

effectively blocked the <strong>State</strong>s from accessing income tax since World War II – except for<br />

a politically unacceptable <strong>of</strong>fer to the <strong>State</strong>s to add income tax surcharges made by the<br />

Fraser Government.<br />

In Germany, the Basic Law specifies financial relations between the Federation and the<br />

<strong>State</strong>s, which are known as Länder. The Basic Law prescribes tax legislation and, in the<br />

case <strong>of</strong> income and corporate pr<strong>of</strong>its tax, how much tax revenue will be distributed<br />

between tiers <strong>of</strong> Government. The Federation and the Länder mostly share income and<br />

corporation tax revenues. This reduces the need to use grants for equalisation purposes<br />

(Table 7.2).<br />

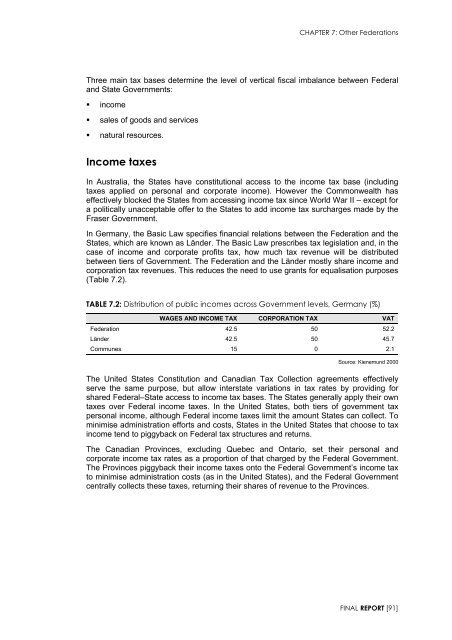

TABLE 7.2: Distribution <strong>of</strong> public incomes across Government levels, Germany (%)<br />

WAGES AND INCOME TAX CORPORATION TAX VAT<br />

Federation 42.5 50 52.2<br />

Länder 42.5 50 45.7<br />

Communes 15 0 2.1<br />

Source: Kienemund 2000<br />

The United <strong>State</strong>s Constitution and Canadian Tax Collection agreements effectively<br />

serve the same purpose, but allow interstate variations in tax rates by providing for<br />

shared Federal–<strong>State</strong> access to income tax bases. The <strong>State</strong>s generally apply their own<br />

taxes over Federal income taxes. In the United <strong>State</strong>s, both tiers <strong>of</strong> government tax<br />

personal income, although Federal income taxes limit the amount <strong>State</strong>s can collect. To<br />

minimise administration efforts and costs, <strong>State</strong>s in the United <strong>State</strong>s that choose to tax<br />

income tend to piggyback on Federal tax structures and returns.<br />

The Canadian Provinces, excluding Quebec and Ontario, set their personal and<br />

corporate income tax rates as a proportion <strong>of</strong> that charged by the Federal Government.<br />

The Provinces piggyback their income taxes onto the Federal Government’s income tax<br />

to minimise administration costs (as in the United <strong>State</strong>s), and the Federal Government<br />

centrally collects these taxes, returning their shares <strong>of</strong> revenue to the Provinces.<br />

FINAL REPORT [91]