Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER 8: Federal Policy Effects<br />

on Interstate Distribution <strong>of</strong> Incomes and Economic Activity<br />

8.2 <strong>Commonwealth</strong> income transfers<br />

and production effects<br />

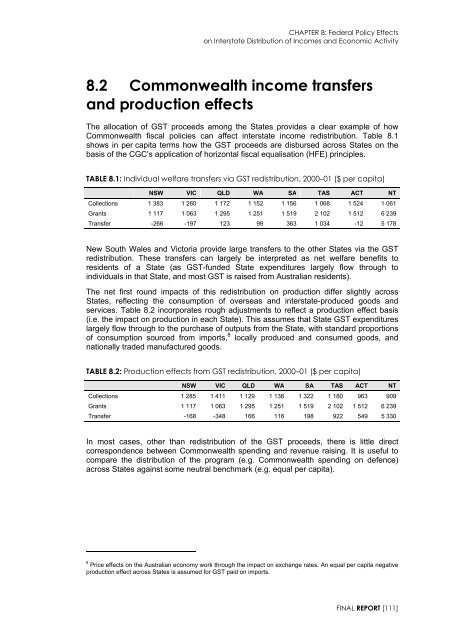

The allocation <strong>of</strong> GST proceeds among the <strong>State</strong>s provides a clear example <strong>of</strong> how<br />

<strong>Commonwealth</strong> fiscal policies can affect interstate income redistribution. Table 8.1<br />

shows in per capita terms how the GST proceeds are disbursed across <strong>State</strong>s on the<br />

basis <strong>of</strong> the CGC’s application <strong>of</strong> horizontal fiscal equalisation (HFE) principles.<br />

TABLE 8.1: Individual welfare transfers via GST redistribution, 2000–01 ($ per capita)<br />

NSW VIC QLD WA SA TAS ACT NT<br />

Collections 1 383 1 260 1 172 1 152 1 156 1 068 1 524 1 061<br />

Grants 1 117 1 063 1 295 1 251 1 519 2 102 1 512 6 239<br />

Transfer -266 -197 123 99 363 1 034 -12 5 178<br />

New South Wales and Victoria provide large transfers to the other <strong>State</strong>s via the GST<br />

redistribution. These transfers can largely be interpreted as net welfare benefits to<br />

residents <strong>of</strong> a <strong>State</strong> (as GST-funded <strong>State</strong> expenditures largely flow through to<br />

individuals in that <strong>State</strong>, and most GST is raised from Australian residents).<br />

The net first round impacts <strong>of</strong> this redistribution on production differ slightly across<br />

<strong>State</strong>s, reflecting the consumption <strong>of</strong> overseas and interstate-produced goods and<br />

services. Table 8.2 incorporates rough adjustments to reflect a production effect basis<br />

(i.e. the impact on production in each <strong>State</strong>). This assumes that <strong>State</strong> GST expenditures<br />

largely flow through to the purchase <strong>of</strong> outputs from the <strong>State</strong>, with standard proportions<br />

<strong>of</strong> consumption sourced from imports, 8 locally produced and consumed goods, and<br />

nationally traded manufactured goods.<br />

TABLE 8.2: Production effects from GST redistribution, 2000–01 ($ per capita)<br />

NSW VIC QLD WA SA TAS ACT NT<br />

Collections 1 285 1 411 1 129 1 136 1 322 1 180 963 909<br />

Grants 1 117 1 063 1 295 1 251 1 519 2 102 1 512 6 239<br />

Transfer -168 -348 166 116 198 922 549 5 330<br />

In most cases, other than redistribution <strong>of</strong> the GST proceeds, there is little direct<br />

correspondence between <strong>Commonwealth</strong> spending and revenue raising. It is useful to<br />

compare the distribution <strong>of</strong> the program (e.g. <strong>Commonwealth</strong> spending on defence)<br />

across <strong>State</strong>s against some neutral benchmark (e.g. equal per capita).<br />

8<br />

Price effects on the Australian economy work through the impact on exchange rates. An equal per capita negative<br />

production effect across <strong>State</strong>s is assumed for GST paid on imports.<br />

FINAL REPORT [111]