Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

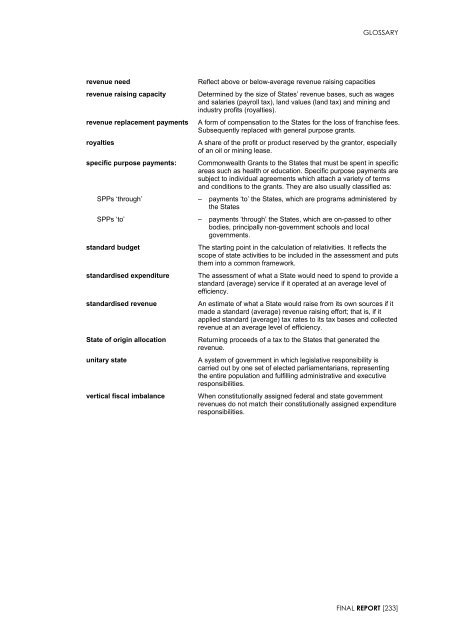

GLOSSARY<br />

revenue need<br />

revenue raising capacity<br />

revenue replacement payments<br />

royalties<br />

specific purpose payments:<br />

SPPs ‘through’<br />

SPPs ‘to’<br />

standard budget<br />

standardised expenditure<br />

standardised revenue<br />

<strong>State</strong> <strong>of</strong> origin allocation<br />

unitary state<br />

vertical fiscal imbalance<br />

Reflect above or below-average revenue raising capacities<br />

Determined by the size <strong>of</strong> <strong>State</strong>s’ revenue bases, such as wages<br />

and salaries (payroll tax), land values (land tax) and mining and<br />

industry pr<strong>of</strong>its (royalties).<br />

A form <strong>of</strong> compensation to the <strong>State</strong>s for the loss <strong>of</strong> franchise fees.<br />

Subsequently replaced with general purpose grants.<br />

A share <strong>of</strong> the pr<strong>of</strong>it or product reserved by the grantor, especially<br />

<strong>of</strong> an oil or mining lease.<br />

<strong>Commonwealth</strong> Grants to the <strong>State</strong>s that must be spent in specific<br />

areas such as health or education. Specific purpose payments are<br />

subject to individual agreements which attach a variety <strong>of</strong> terms<br />

and conditions to the grants. They are also usually classified as:<br />

– payments ‘to’ the <strong>State</strong>s, which are programs administered by<br />

the <strong>State</strong>s<br />

– payments ‘through’ the <strong>State</strong>s, which are on-passed to other<br />

bodies, principally non-government schools and local<br />

governments.<br />

The starting point in the calculation <strong>of</strong> relativities. It reflects the<br />

scope <strong>of</strong> state activities to be included in the assessment and puts<br />

them into a common framework.<br />

The assessment <strong>of</strong> what a <strong>State</strong> would need to spend to provide a<br />

standard (average) service if it operated at an average level <strong>of</strong><br />

efficiency.<br />

An estimate <strong>of</strong> what a <strong>State</strong> would raise from its own sources if it<br />

made a standard (average) revenue raising effort; that is, if it<br />

applied standard (average) tax rates to its tax bases and collected<br />

revenue at an average level <strong>of</strong> efficiency.<br />

Returning proceeds <strong>of</strong> a tax to the <strong>State</strong>s that generated the<br />

revenue.<br />

A system <strong>of</strong> government in which legislative responsibility is<br />

carried out by one set <strong>of</strong> elected parliamentarians, representing<br />

the entire population and fulfilling administrative and executive<br />

responsibilities.<br />

When constitutionally assigned federal and state government<br />

revenues do not match their constitutionally assigned expenditure<br />

responsibilities.<br />

FINAL REPORT [233]