Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHAPTER 7: Other Federations<br />

While the Canada Health and Social Transfer allows Provinces more control over<br />

program spending, conditions are attached. These are outlined in the Canada Health<br />

Act 1984, which regulates the public health care system and attempts to prevent<br />

discrimination in provincial social programs against recent migrants from other<br />

Provinces. Conditions are not onerous as there is no requirement to maintain a<br />

particular level <strong>of</strong> spending in an area or to achieve a particular outcome. There is no<br />

mechanism for Federal auditing beyond the legislated requirement to provide<br />

information to assist the Federal Minister <strong>of</strong> Health in determining whether conditions<br />

have been violated. In practice, it has been very difficult for the Federal Government to<br />

enforce these conditions without negotiating with the Provinces.<br />

In April 1996 the Canada Health and Social Transfer replaced the specific purpose<br />

transfers <strong>of</strong> the Established Programs Financing and the Canadian Assistance Plan<br />

programs. Uneven per capita allocations are a legacy <strong>of</strong> the previous systems. The<br />

1998 Budget announced that previous disparities in funding would be eliminated by<br />

2001–02 when all Provinces would receive equal per capita Canada Health and Social<br />

Transfer entitlements. Equal per capita distribution is recognised as being significantly<br />

equalising because it involves the distribution <strong>of</strong> Federal funds from Provinces with<br />

revenue raising capacities above the average to those below the average.<br />

The Canadian Equalisation Program is a constitutionally mandated unconditional block<br />

transfer program. It was established in 1996 and its objectives are specified in terms<br />

reminiscent <strong>of</strong> pre-1977 Australian fiscal equalisation objectives. Federal Equalization<br />

payments enable less prosperous provincial Governments to provide their residents with<br />

public services that are reasonably comparable to those in other Provinces, at<br />

reasonably comparable levels <strong>of</strong> taxation (Rayner et al. 2001). The equalisation formula<br />

lowers revenue differentials but does not eliminate them, and does not consider<br />

expenditure needs.<br />

The Equalisation Program embodies bottom-up equalisation; that is where revenue-poor<br />

Provinces are equalised up towards the national average. The revenue-rich Provinces<br />

are not equalised down, as is the case under a full equalisation formula, although<br />

implicit redistribution occurs because more Federal funds come from the Provinces<br />

paying proportionately more in Federal taxes. The overall effect falls well short <strong>of</strong> the<br />

extreme equalisation implemented in Australia.<br />

Canada’s equalisation program is aimed at lifting the fiscal capacity <strong>of</strong> the eight<br />

revenue-poor Provinces towards the levels <strong>of</strong> Alberta and Ontario. The revenue raising<br />

capacity <strong>of</strong> the revenue-poor Provinces is not fully equalised to the national average<br />

(Coulombe and Merette 2000).<br />

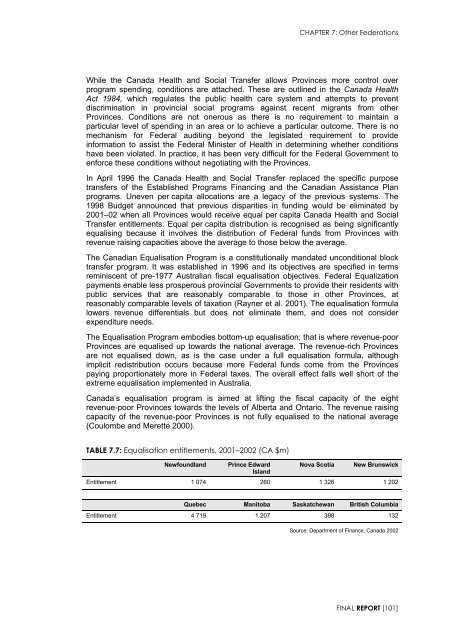

TABLE 7.7: Equalisation entitlements, 2001–2002 (CA $m)<br />

Newfoundland<br />

Prince Edward<br />

Island<br />

Nova Scotia<br />

New Brunswick<br />

Entitlement 1 074 260 1 326 1 202<br />

Quebec Manitoba Saskatchewan British Columbia<br />

Entitlement 4 719 1 207 398 132<br />

Source: Department <strong>of</strong> Finance, Canada 2002<br />

FINAL REPORT [101]