Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Garnaut Fitzgerald Review of Commonwealth-State Funding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

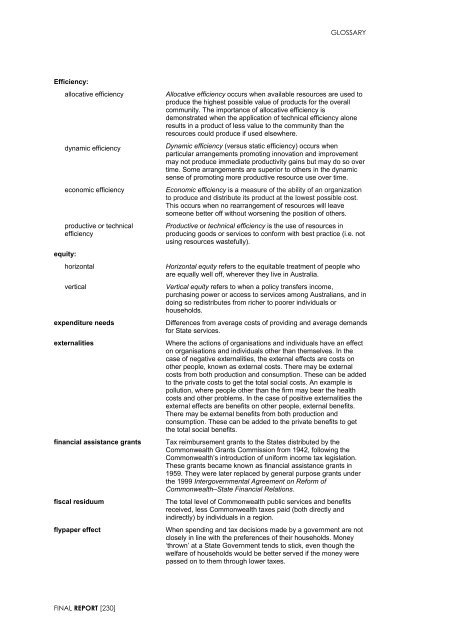

GLOSSARY<br />

Efficiency:<br />

allocative efficiency<br />

dynamic efficiency<br />

economic efficiency<br />

productive or technical<br />

efficiency<br />

equity:<br />

horizontal<br />

vertical<br />

expenditure needs<br />

externalities<br />

financial assistance grants<br />

fiscal residuum<br />

flypaper effect<br />

Allocative efficiency occurs when available resources are used to<br />

produce the highest possible value <strong>of</strong> products for the overall<br />

community. The importance <strong>of</strong> allocative efficiency is<br />

demonstrated when the application <strong>of</strong> technical efficiency alone<br />

results in a product <strong>of</strong> less value to the community than the<br />

resources could produce if used elsewhere.<br />

Dynamic efficiency (versus static efficiency) occurs when<br />

particular arrangements promoting innovation and improvement<br />

may not produce immediate productivity gains but may do so over<br />

time. Some arrangements are superior to others in the dynamic<br />

sense <strong>of</strong> promoting more productive resource use over time.<br />

Economic efficiency is a measure <strong>of</strong> the ability <strong>of</strong> an organization<br />

to produce and distribute its product at the lowest possible cost.<br />

This occurs when no rearrangement <strong>of</strong> resources will leave<br />

someone better <strong>of</strong>f without worsening the position <strong>of</strong> others.<br />

Productive or technical efficiency is the use <strong>of</strong> resources in<br />

producing goods or services to conform with best practice (i.e. not<br />

using resources wastefully).<br />

Horizontal equity refers to the equitable treatment <strong>of</strong> people who<br />

are equally well <strong>of</strong>f, wherever they live in Australia.<br />

Vertical equity refers to when a policy transfers income,<br />

purchasing power or access to services among Australians, and in<br />

doing so redistributes from richer to poorer individuals or<br />

households.<br />

Differences from average costs <strong>of</strong> providing and average demands<br />

for <strong>State</strong> services.<br />

Where the actions <strong>of</strong> organisations and individuals have an effect<br />

on organisations and individuals other than themselves. In the<br />

case <strong>of</strong> negative externalities, the external effects are costs on<br />

other people, known as external costs. There may be external<br />

costs from both production and consumption. These can be added<br />

to the private costs to get the total social costs. An example is<br />

pollution, where people other than the firm may bear the health<br />

costs and other problems. In the case <strong>of</strong> positive externalities the<br />

external effects are benefits on other people, external benefits.<br />

There may be external benefits from both production and<br />

consumption. These can be added to the private benefits to get<br />

the total social benefits.<br />

Tax reimbursement grants to the <strong>State</strong>s distributed by the<br />

<strong>Commonwealth</strong> Grants Commission from 1942, following the<br />

<strong>Commonwealth</strong>’s introduction <strong>of</strong> uniform income tax legislation.<br />

These grants became known as financial assistance grants in<br />

1959. They were later replaced by general purpose grants under<br />

the 1999 Intergovernmental Agreement on Reform <strong>of</strong><br />

<strong>Commonwealth</strong>–<strong>State</strong> Financial Relations.<br />

The total level <strong>of</strong> <strong>Commonwealth</strong> public services and benefits<br />

received, less <strong>Commonwealth</strong> taxes paid (both directly and<br />

indirectly) by individuals in a region.<br />

When spending and tax decisions made by a government are not<br />

closely in line with the preferences <strong>of</strong> their households. Money<br />

‘thrown’ at a <strong>State</strong> Government tends to stick, even though the<br />

welfare <strong>of</strong> households would be better served if the money were<br />

passed on to them through lower taxes.<br />

FINAL REPORT [230]