Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

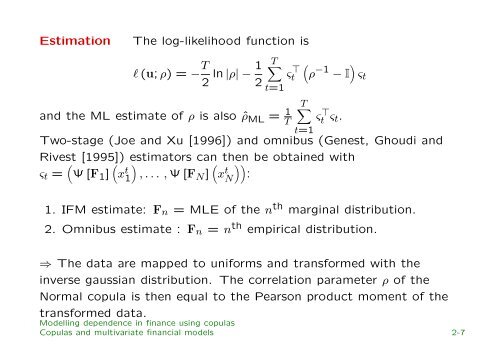

Estimation<br />

The log-likelihood function is<br />

l (u; ρ) = − T 2 ln |ρ| − 1 2<br />

T∑<br />

ςt<br />

⊤<br />

t=1<br />

(<br />

ρ −1 − I ) ς t<br />

and the ML estimate of ρ is also ˆρ ML = 1 T<br />

T∑<br />

t=1<br />

ς ⊤ t ς t.<br />

Two-stage (Joe and Xu [1996]) and omnibus (Genest, Ghoudi and<br />

Rivest [1995]) estimators can then be obta<strong>in</strong>ed with<br />

ς t = ( Ψ [F 1 ]<br />

(<br />

x<br />

t<br />

1<br />

)<br />

, . . . , Ψ [FN ]<br />

(<br />

x<br />

t<br />

N<br />

))<br />

:<br />

1. IFM estimate: F n = MLE of the n th marg<strong>in</strong>al distribution.<br />

2. Omnibus estimate : F n = n th empirical distribution.<br />

⇒ The data are mapped to uniforms and transformed with the<br />

<strong>in</strong>verse gaussian distribution. The correlation parameter ρ of the<br />

Normal copula is then equal to the Pearson product moment of the<br />

transformed data.<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

Copulas and multivariate f<strong>in</strong>ancial models 2-7