Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

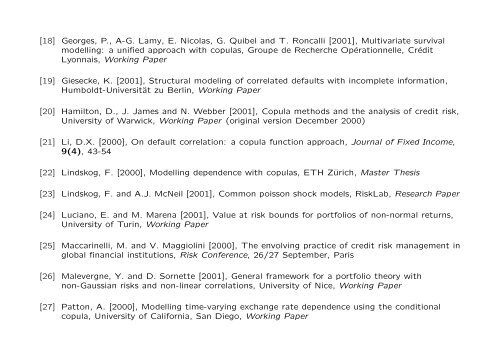

[18] Georges, P., A-G. Lamy, E. Nicolas, G. Quibel and T. Roncalli [2001], Multivariate survival<br />

modell<strong>in</strong>g: a unified approach with <strong>copulas</strong>, Groupe de Recherche Opérationnelle, Crédit<br />

Lyonnais, Work<strong>in</strong>g Paper<br />

[19] Giesecke, K. [2001], Structural model<strong>in</strong>g of correlated defaults with <strong>in</strong>complete <strong>in</strong>formation,<br />

Humboldt-Universität zu Berl<strong>in</strong>, Work<strong>in</strong>g Paper<br />

[20] Hamilton, D., J. James and N. Webber [2001], Copula methods and the analysis of credit risk,<br />

University of Warwick, Work<strong>in</strong>g Paper (orig<strong>in</strong>al version December 2000)<br />

[21] Li, D.X. [2000], On default correlation: a copula function approach, Journal of Fixed Income,<br />

9(4), 43-54<br />

[22] L<strong>in</strong>dskog, F. [2000], <strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> with <strong>copulas</strong>, ETH Zürich, Master Thesis<br />

[23] L<strong>in</strong>dskog, F. and A.J. McNeil [2001], Common poisson shock models, RiskLab, Research Paper<br />

[24] Luciano, E. and M. Marena [2001], Value at risk bounds for portfolios of non-normal returns,<br />

University of Tur<strong>in</strong>, Work<strong>in</strong>g Paper<br />

[25] Maccar<strong>in</strong>elli, M. and V. Maggiol<strong>in</strong>i [2000], The envolv<strong>in</strong>g practice of credit risk management <strong>in</strong><br />

global f<strong>in</strong>ancial <strong>in</strong>stitutions, Risk Conference, 26/27 September, Paris<br />

[26] Malevergne, Y. and D. Sornette [2001], General framework for a portfolio theory with<br />

non-Gaussian risks and non-l<strong>in</strong>ear correlations, University of Nice, Work<strong>in</strong>g Paper<br />

[27] Patton, A. [2000], <strong>Modell<strong>in</strong>g</strong> time-vary<strong>in</strong>g exchange rate <strong>dependence</strong> us<strong>in</strong>g the conditional<br />

copula, University of California, San Diego, Work<strong>in</strong>g Paper