Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

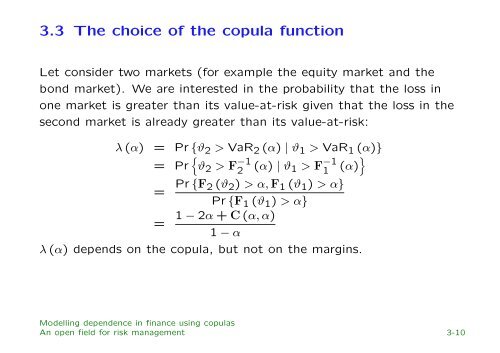

3.3 The choice of the copula function<br />

Let consider two markets (for example the equity market and the<br />

bond market). We are <strong>in</strong>terested <strong>in</strong> the probability that the loss <strong>in</strong><br />

one market is greater than its value-at-risk given that the loss <strong>in</strong> the<br />

second market is already greater than its value-at-risk:<br />

λ (α) = Pr {ϑ 2 > VaR 2 (α) | ϑ 1 > VaR 1 (α)}<br />

= Pr { ϑ 2 > F −1<br />

2 (α) | ϑ 1 > F −1 }<br />

1 (α)<br />

= Pr {F 2 (ϑ 2 ) > α, F 1 (ϑ 1 ) > α}<br />

Pr {F 1 (ϑ 1 ) > α}<br />

1 − 2α + C (α, α)<br />

=<br />

1 − α<br />

λ (α) depends on the copula, but not on the marg<strong>in</strong>s.<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

An open field for risk management 3-10