Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

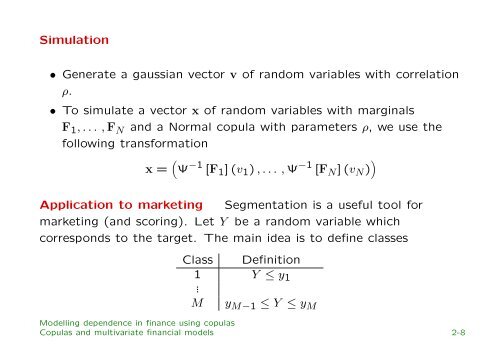

Simulation<br />

• Generate a gaussian vector v of random variables with correlation<br />

ρ.<br />

• To simulate a vector x of random variables with marg<strong>in</strong>als<br />

F 1 , . . . , F N and a Normal copula with parameters ρ, we use the<br />

follow<strong>in</strong>g transformation<br />

x = ( Ψ −1 [F 1 ] (v 1 ) , . . . , Ψ −1 [F N ] (v N )<br />

)<br />

Application to market<strong>in</strong>g Segmentation is a useful tool for<br />

market<strong>in</strong>g (and scor<strong>in</strong>g). Let Y be a random variable which<br />

corresponds to the target. The ma<strong>in</strong> idea is to def<strong>in</strong>e classes<br />

Class Def<strong>in</strong>ition<br />

1<br />

.<br />

Y ≤ y 1<br />

M y M−1 ≤ Y ≤ y M<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

Copulas and multivariate f<strong>in</strong>ancial models 2-8