Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

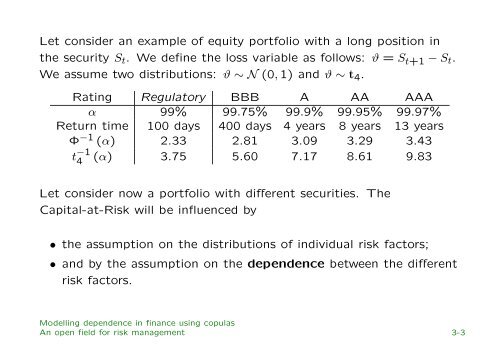

Let consider an example of equity portfolio with a long position <strong>in</strong><br />

the security S t . We def<strong>in</strong>e the loss variable as follows: ϑ = S t+1 − S t .<br />

We assume two distributions: ϑ ∼ N (0, 1) and ϑ ∼ t 4 .<br />

Rat<strong>in</strong>g Regulatory BBB A AA AAA<br />

α 99% 99.75% 99.9% 99.95% 99.97%<br />

Return time 100 days 400 days 4 years 8 years 13 years<br />

Φ −1 (α) 2.33 2.81 3.09 3.29 3.43<br />

t −1<br />

4<br />

(α) 3.75 5.60 7.17 8.61 9.83<br />

Let consider now a portfolio with different securities. The<br />

Capital-at-Risk will be <strong>in</strong>fluenced by<br />

• the assumption on the distributions of <strong>in</strong>dividual risk factors;<br />

• and by the assumption on the <strong>dependence</strong> between the different<br />

risk factors.<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

An open field for risk management 3-3