Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

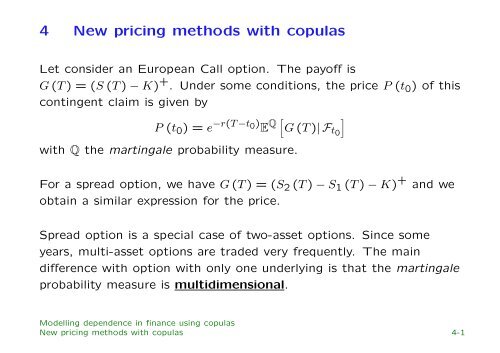

4 New pric<strong>in</strong>g methods with <strong>copulas</strong><br />

Let consider an European Call option. The payoff is<br />

G (T ) = (S (T ) − K) + . Under some conditions, the price P (t 0 ) of this<br />

cont<strong>in</strong>gent claim is given by<br />

P (t 0 ) = e −r(T −t 0) E Q [ G (T )| F t0<br />

]<br />

with Q the mart<strong>in</strong>gale probability measure.<br />

For a spread option, we have G (T ) = (S 2 (T ) − S 1 (T ) − K) + and we<br />

obta<strong>in</strong> a similar expression for the price.<br />

Spread option is a special case of two-asset options. S<strong>in</strong>ce some<br />

years, multi-asset options are traded very frequently. The ma<strong>in</strong><br />

difference with option with only one underly<strong>in</strong>g is that the mart<strong>in</strong>gale<br />

probability measure is multidimensional.<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

New pric<strong>in</strong>g methods with <strong>copulas</strong> 4-1