Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

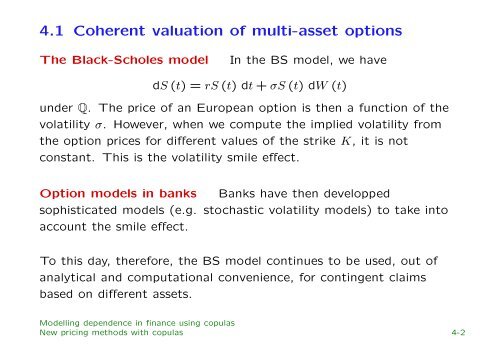

4.1 Coherent valuation of multi-asset options<br />

The Black-Scholes model<br />

In the BS model, we have<br />

dS (t) = rS (t) dt + σS (t) dW (t)<br />

under Q. The price of an European option is then a function of the<br />

volatility σ. However, when we compute the implied volatility from<br />

the option prices for different values of the strike K, it is not<br />

constant. This is the volatility smile effect.<br />

Option models <strong>in</strong> banks Banks have then developped<br />

sophisticated models (e.g. stochastic volatility models) to take <strong>in</strong>to<br />

account the smile effect.<br />

To this day, therefore, the BS model cont<strong>in</strong>ues to be used, out of<br />

analytical and computational convenience, for cont<strong>in</strong>gent claims<br />

based on different assets.<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

New pric<strong>in</strong>g methods with <strong>copulas</strong> 4-2