Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

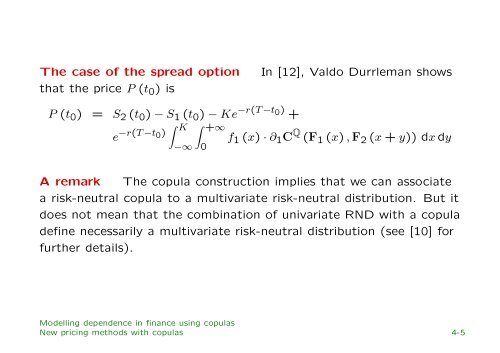

The case of the spread option<br />

that the price P (t 0 ) is<br />

In [12], Valdo Durrleman shows<br />

P (t 0 ) = S 2 (t 0 ) − S 1 (t 0 ) − Ke −r(T −t 0) +<br />

e −r(T −t 0) ∫ K<br />

−∞ 0<br />

∫ +∞<br />

f 1 (x) · ∂ 1 C Q (F 1 (x) , F 2 (x + y)) dx dy<br />

A remark The copula construction implies that we can associate<br />

a risk-neutral copula to a multivariate risk-neutral distribution. But it<br />

does not mean that the comb<strong>in</strong>ation of univariate RND with a copula<br />

def<strong>in</strong>e necessarily a multivariate risk-neutral distribution (see [10] for<br />

further details).<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

New pric<strong>in</strong>g methods with <strong>copulas</strong> 4-5