Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

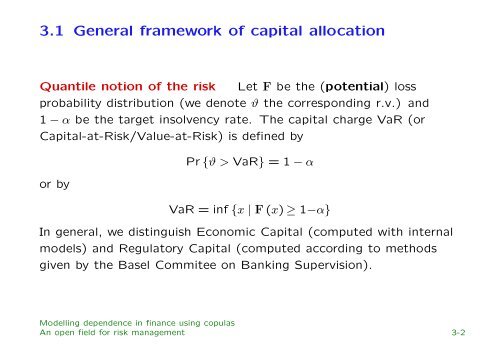

3.1 General framework of capital allocation<br />

Quantile notion of the risk Let F be the (potential) loss<br />

probability distribution (we denote ϑ the correspond<strong>in</strong>g r.v.) and<br />

1 − α be the target <strong>in</strong>solvency rate. The capital charge VaR (or<br />

Capital-at-Risk/Value-at-Risk) is def<strong>in</strong>ed by<br />

or by<br />

Pr {ϑ > VaR} = 1 − α<br />

VaR = <strong>in</strong>f {x | F (x) ≥ 1−α}<br />

In general, we dist<strong>in</strong>guish Economic Capital (computed with <strong>in</strong>ternal<br />

models) and Regulatory Capital (computed accord<strong>in</strong>g to methods<br />

given by the Basel Commitee on Bank<strong>in</strong>g Supervision).<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

An open field for risk management 3-2