Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

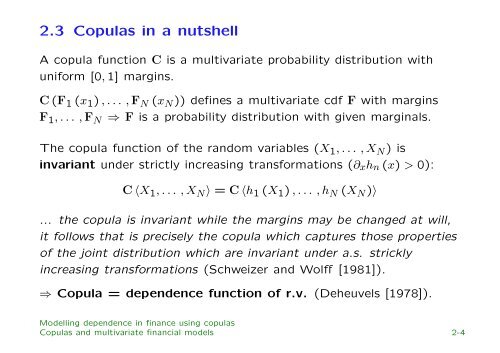

2.3 Copulas <strong>in</strong> a nutshell<br />

A copula function C is a multivariate probability distribution with<br />

uniform [0, 1] marg<strong>in</strong>s.<br />

C (F 1 (x 1 ) , . . . , F N (x N )) def<strong>in</strong>es a multivariate cdf F with marg<strong>in</strong>s<br />

F 1 , . . . , F N ⇒ F is a probability distribution with given marg<strong>in</strong>als.<br />

The copula function of the random variables (X 1 , . . . , X N ) is<br />

<strong>in</strong>variant under strictly <strong>in</strong>creas<strong>in</strong>g transformations (∂ x h n (x) > 0):<br />

C 〈X 1 , . . . , X N 〉 = C 〈h 1 (X 1 ) , . . . , h N (X N )〉<br />

... the copula is <strong>in</strong>variant while the marg<strong>in</strong>s may be changed at will,<br />

it follows that is precisely the copula which captures those properties<br />

of the jo<strong>in</strong>t distribution which are <strong>in</strong>variant under a.s. strickly<br />

<strong>in</strong>creas<strong>in</strong>g transformations (Schweizer and Wolff [1981]).<br />

⇒ Copula = <strong>dependence</strong> function of r.v. (Deheuvels [1978]).<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

Copulas and multivariate f<strong>in</strong>ancial models 2-4