Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

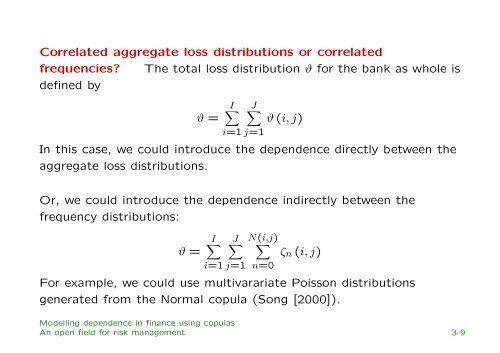

Correlated aggregate loss distributions or correlated<br />

frequencies The total loss distribution ϑ for the bank as whole is<br />

def<strong>in</strong>ed by<br />

ϑ =<br />

I∑<br />

J∑<br />

i=1 j=1<br />

ϑ (i, j)<br />

In this case, we could <strong>in</strong>troduce the <strong>dependence</strong> directly between the<br />

aggregate loss distributions.<br />

Or, we could <strong>in</strong>troduce the <strong>dependence</strong> <strong>in</strong>directly between the<br />

frequency distributions:<br />

ϑ =<br />

I∑<br />

J∑<br />

i=1 j=1<br />

N(i,j)<br />

∑<br />

n=0<br />

ζ n (i, j)<br />

For example, we could use multivarariate Poisson distributions<br />

generated from the Normal copula (Song [2000]).<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

An open field for risk management 3-9