Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

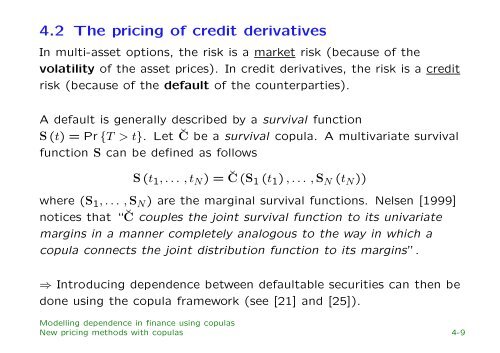

4.2 The pric<strong>in</strong>g of credit derivatives<br />

In multi-asset options, the risk is a market risk (because of the<br />

volatility of the asset prices). In credit derivatives, the risk is a credit<br />

risk (because of the default of the counterparties).<br />

A default is generally described by a survival function<br />

S (t) = Pr {T > t}. Let ˘C be a survival copula. A multivariate survival<br />

function S can be def<strong>in</strong>ed as follows<br />

S (t 1 , . . . , t N ) = ˘C (S 1 (t 1 ) , . . . , S N (t N ))<br />

where (S 1 , . . . , S N ) are the marg<strong>in</strong>al survival functions. Nelsen [1999]<br />

notices that “ ˘C couples the jo<strong>in</strong>t survival function to its univariate<br />

marg<strong>in</strong>s <strong>in</strong> a manner completely analogous to the way <strong>in</strong> which a<br />

copula connects the jo<strong>in</strong>t distribution function to its marg<strong>in</strong>s”.<br />

⇒ Introduc<strong>in</strong>g <strong>dependence</strong> between defaultable securities can then be<br />

done us<strong>in</strong>g the copula framework (see [21] and [25]).<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

New pric<strong>in</strong>g methods with <strong>copulas</strong> 4-9