Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

Modelling dependence in finance using copulas - Thierry Roncalli's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

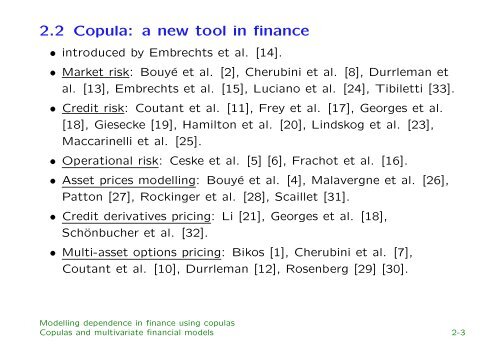

2.2 Copula: a new tool <strong>in</strong> f<strong>in</strong>ance<br />

• <strong>in</strong>troduced by Embrechts et al. [14].<br />

• Market risk: Bouyé et al. [2], Cherub<strong>in</strong>i et al. [8], Durrleman et<br />

al. [13], Embrechts et al. [15], Luciano et al. [24], Tibiletti [33].<br />

• Credit risk: Coutant et al. [11], Frey et al. [17], Georges et al.<br />

[18], Giesecke [19], Hamilton et al. [20], L<strong>in</strong>dskog et al. [23],<br />

Maccar<strong>in</strong>elli et al. [25].<br />

• Operational risk: Ceske et al. [5] [6], Frachot et al. [16].<br />

• Asset prices modell<strong>in</strong>g: Bouyé et al. [4], Malavergne et al. [26],<br />

Patton [27], Rock<strong>in</strong>ger et al. [28], Scaillet [31].<br />

• Credit derivatives pric<strong>in</strong>g: Li [21], Georges et al. [18],<br />

Schönbucher et al. [32].<br />

• Multi-asset options pric<strong>in</strong>g: Bikos [1], Cherub<strong>in</strong>i et al. [7],<br />

Coutant et al. [10], Durrleman [12], Rosenberg [29] [30].<br />

<strong>Modell<strong>in</strong>g</strong> <strong>dependence</strong> <strong>in</strong> f<strong>in</strong>ance us<strong>in</strong>g <strong>copulas</strong><br />

Copulas and multivariate f<strong>in</strong>ancial models 2-3