BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

6. TAXATION EXPENSE continued<br />

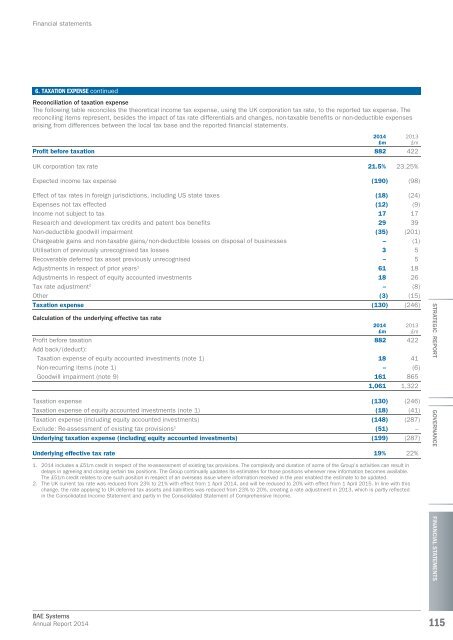

Reconciliation of taxation expense<br />

The following table reconciles the theoretical income tax expense, using the UK corporation tax rate, to the <strong>report</strong>ed tax expense. The<br />

reconciling items represent, besides the impact of tax rate differentials and changes, non-taxable benefits or non-deductible expenses<br />

arising from differences between the local tax base and the <strong>report</strong>ed financial statements.<br />

Profit before taxation 882 422<br />

UK corporation tax rate 21.5% 23.25%<br />

Expected income tax expense (190) (98)<br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

Effect of tax rates in foreign jurisdictions, including US state taxes (18) (24)<br />

Expenses not tax effected (12) (9)<br />

Income not subject to tax 17 17<br />

Research and development tax credits and patent box benefits 29 39<br />

Non-deductible goodwill impairment (35) (201)<br />

Chargeable gains and non-taxable gains/non-deductible losses on disposal of businesses – (1)<br />

Utilisation of previously unrecognised tax losses 3 5<br />

Recoverable deferred tax asset previously unrecognised – 5<br />

Adjustments in respect of prior years 1 61 18<br />

Adjustments in respect of equity accounted investments 18 26<br />

Tax rate adjustment 2 – (8)<br />

Other (3) (15)<br />

Taxation expense (130) (246)<br />

Calculation of the underlying effective tax rate<br />

Profit before taxation 882 422<br />

Add back/(deduct):<br />

Taxation expense of equity accounted investments (note 1) 18 41<br />

Non-recurring items (note 1) – (6)<br />

Goodwill impairment (note 9) 161 865<br />

1,061 1,322<br />

Taxation expense (130) (246)<br />

Taxation expense of equity accounted investments (note 1) (18) (41)<br />

Taxation expense (including equity accounted investments) (148) (287)<br />

Exclude: Re-assessment of existing tax provisions 1 (51) –<br />

Underlying taxation expense (including equity accounted investments) (199) (287)<br />

Underlying effective tax rate 19% 22%<br />

1. <strong>2014</strong> includes a £51m credit in respect of the re-assessment of existing tax provisions. The complexity and duration of some of the Group’s activities can result in<br />

delays in agreeing and closing certain tax positions. The Group continually updates its estimates for those positions whenever new information becomes available.<br />

The £51m credit relates to one such position in respect of an overseas issue where information received in the year enabled the estimate to be updated.<br />

2. The UK current tax rate was reduced from 23% to 21% with effect from 1 April <strong>2014</strong>, and will be reduced to 20% with effect from 1 April 2015. In line with this<br />

change, the rate applying to UK deferred tax assets and liabilities was reduced from 23% to 20%, creating a rate adjustment in 2013, which is partly reflected<br />

in the Consolidated Income Statement and partly in the Consolidated Statement of Comprehensive Income.<br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

STRATEGIC REPORT GOVERNANCE<br />

FINANCIAL STATEMENTS<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

115