BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Strategic Report<br />

<strong>2014</strong> AT<br />

A GLANCE<br />

IN <strong>2014</strong>,<br />

<strong>BAE</strong> SYSTEMS<br />

DELIVERED<br />

A SOLID<br />

OVERALL<br />

PERFORMANCE<br />

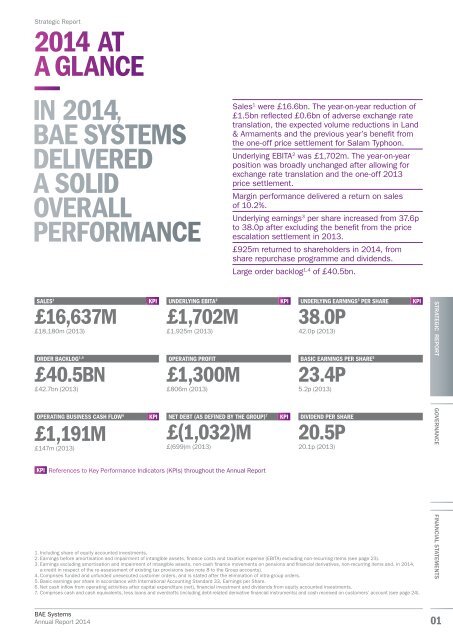

Sales 1 were £16.6bn. The year-on-year reduction of<br />

£1.5bn reflected £0.6bn of adverse exchange rate<br />

translation, the expected volume reductions in Land<br />

& Armaments and the previous year’s benefit from<br />

the one-off price settlement for Salam Typhoon.<br />

Underlying EBITA 2 was £1,702m. The year-on-year<br />

position was broadly unchanged after allowing for<br />

exchange rate translation and the one-off 2013<br />

price settlement.<br />

Margin performance delivered a return on sales<br />

of 10.2%.<br />

Underlying earnings 3 per share increased from 37.6p<br />

to 38.0p after excluding the benefit from the price<br />

escalation settlement in 2013.<br />

£925m returned to shareholders in <strong>2014</strong>, from<br />

share repurchase programme and dividends.<br />

Large order backlog 1,4 of £40.5bn.<br />

SALES 1<br />

£16,637M<br />

£18,180m (2013)<br />

ORDER BACKLOG 1,4<br />

£40.5BN<br />

£42.7bn (2013)<br />

OPERATING BUSINESS CASH FLOW 6<br />

£1,191M<br />

£147m (2013)<br />

KPI<br />

KPI<br />

UNDERLYING EBITA 2<br />

£1,702M<br />

£1,925m (2013)<br />

OPERATING PROFIT<br />

£1,300M<br />

£806m (2013)<br />

NET DEBT (AS DEFINED BY THE GROUP) 7<br />

£(1,032)M<br />

£(699)m (2013)<br />

KPI References to Key Performance Indicators (KPIs) throughout the Annual Report<br />

KPI<br />

KPI<br />

UNDERLYING EARNINGS 3 PER SHARE<br />

38.0P<br />

42.0p (2013)<br />

BASIC EARNINGS PER SHARE 5<br />

23.4P<br />

5.2p (2013)<br />

DIVIDEND PER SHARE<br />

20.5P<br />

20.1p (2013)<br />

1. Including share of equity accounted investments.<br />

2. Earnings before amortisation and impairment of intangible assets, finance costs and taxation expense (EBITA) excluding non-recurring items (see page 23).<br />

3. Earnings excluding amortisation and impairment of intangible assets, non-cash finance movements on pensions and financial derivatives, non-recurring items and, in <strong>2014</strong>,<br />

a credit in respect of the re-assessment of existing tax provisions (see note 8 to the Group accounts).<br />

4. Comprises funded and unfunded unexecuted customer orders, and is stated after the elimination of intra-group orders.<br />

5. Basic earnings per share in accordance with International Accounting Standard 33, Earnings per Share.<br />

6. Net cash inflow from operating activities after capital expenditure (net), financial investment and dividends from equity accounted investments.<br />

7. Comprises cash and cash equivalents, less loans and overdrafts (including debt-related derivative financial instruments) and cash received on customers’ account (see page 24).<br />

KPI<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

01